10 REITs with the best tracks records for high dividend yields

The Real Estate Investment Trust subsector of the S&P Composite 1500 has been a big performer this year. REITs have returned 14%, almost three times that of the index.

It’s taken considerably longer than some investors expected for the Federal Reserve to raise the short-term federal funds rate, which has been locked in a range of zero to 0.25% since late 2008.

The current consensus is that the Fed will finally allow rates to rise in the middle of 2015. That will put pressure on prices for all types of income-producing investments, including REITs. That’s because yields of existing fixed-income securities will match those of new issues.

Mortgage REITs, which primarily invest in agency mortgage-backed securities, will be especially sensitive, because the market values of their investments will fall. Equity REITs, which purchase, develop, manage and sell commercial and multifamily properties, may be less sensitive to the interest-rate increases because the market values of their investments may rise.

In the first part of this series, we discussed investors’ motivation for buying stocks with high dividend yields. If income is the objective, and the companies are otherwise healthy and easily covering their dividends with cash flow, the dividends should continue to flow, even if share prices drop following a rate increase.

For well-managed equity REITs, investors can also look forward to continued growth, as property prices rise or as the companies continue to make new investments.

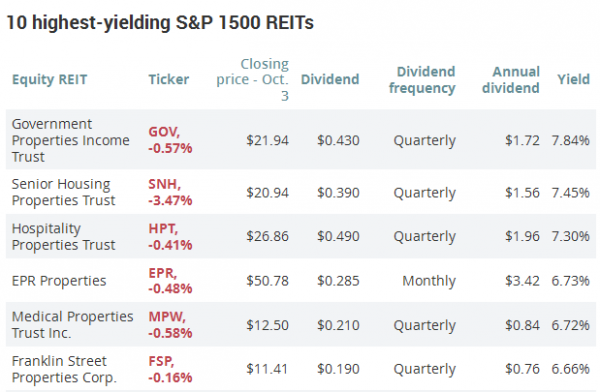

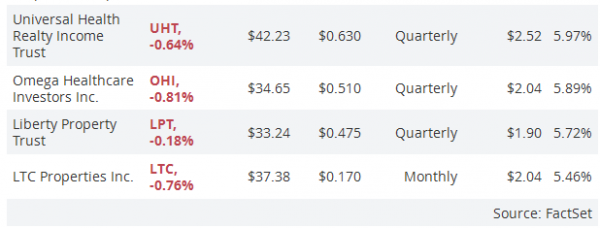

Here’s a list of the highest-yielding equity REITs included in the S&P 1500 as of Friday’s market close. Once again, we have taken the conservative step of limiting the group to companies that have declared dividends for at least five years and have not lowered their regular dividends for the past four full years.

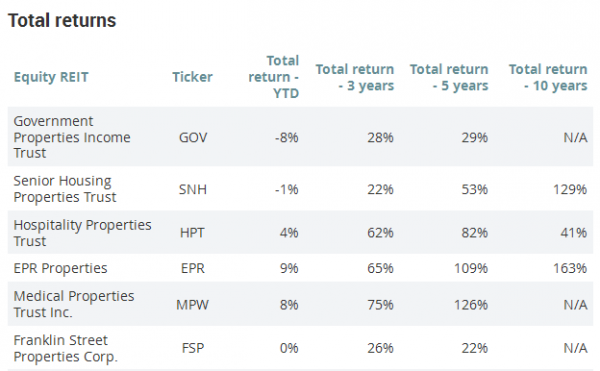

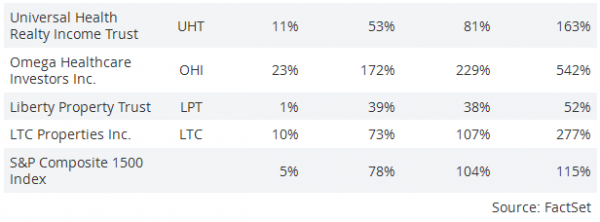

Here’s how these REITs have performed on a total return basis, with dividends reinvested. While many REIT investors don’t reinvest, because they want income, we’re using total returns for easier comparison to the S&P 1500 Index:

Among the highest-yielding REIT components of the S&P 1500, only half have beaten the index so far this year. The track record gets even worse when looking at some longer periods.

The clear champion is Omega Healthcare Investors Inc., which is up 23% this year and has beaten the index and the other REITs by a wide margin for all periods. It would seem that a focused strategy of investing in income-producing health-care properties across the United States is a winning strategy, considering that the customer base grows as population ages.

A closer look

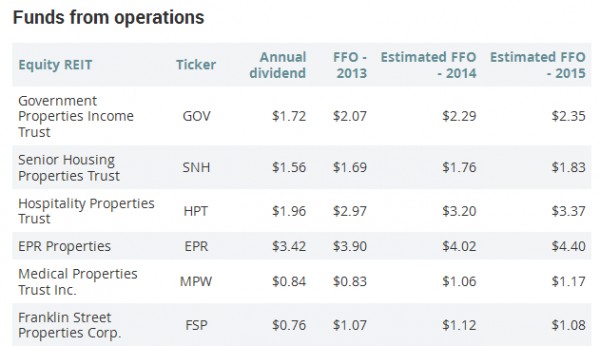

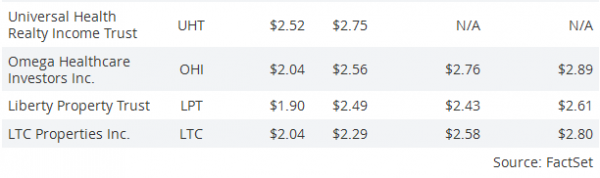

Equity REITs report funds from operations (FFO), a non-GAAP measure of net income, excluding gains or losses from sales of property and also excluding real estate depreciation. It is a commonly accepted measure of operating performance for REITs.

Here’s the same group of REITs, comparing the current annual dividend rate to FFO for 2013 and estimates for 2014 and 2015. We have also added price-to-FFO ratios.

All of these REITs, except for Medical Properties Trust, had sufficient FFO in 2013 to cover the current dividend payout rate, and analysts expect all to easily to cover dividends from FFO, except Universal Health Realty Income Trust, for which no consensus estimate is available.

So the dividends appear safe. Whether you have the stomach to ride out a long period of pressure on the stock prices as interest rates rise, while enjoying the continued income stream, is another matter.