Sunnyvale Town Center – 94086

Sunnyvale Town Center – 94086

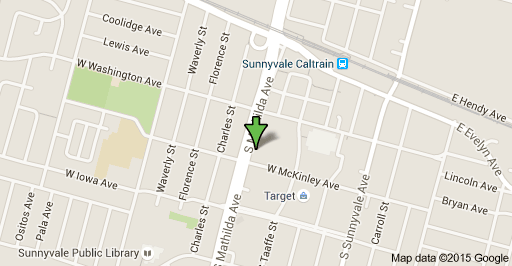

250 S Mathilda Ave, Sunnyvale, CA 94086, United States

Sunnyvale Town Center was a 36-acre two-level shopping mall located in Sunnyvale, California, USA. It was anchored by Macy’s, Target, and J.C

Sunnyvale Town Center was a 36-acre[1] two-level shopping mall located in Sunnyvale, California, USA. It was anchored by Macy’s, Target, and J.C. Penney. As of August 2015, only the Target and Macy’s stores remain operational: much of the mall consists of a construction site on which work was stalled from 2009 to 2015 a result of a legal dispute. In August 2015 the litigation ended, and Wells Fargo announced that it sought to sell the mall to a developer.

History

The mall, bounded by Mathilda Avenue, Washington Avenue, Sunnyvale Avenue, and Iowa Avenue, opened in 1979. Over the years, the development went through a series of owners who either defaulted on loans, or were sued for breach of contract. During that time, the mall fell into decline with changing tastes of shoppers and the emergence of newer and larger competitors. Finally, in 2007, new entities named “Downtown Sunnyvale Mixed Use LLC” (DSMU) and “Downtown Sunnyvale Residential LLC” (DSR) took over the mall. DSMU and DSR were partnerships between Silicon Valley developer Peter Pau’s Sand Hill Property Co. (which owned about 5%), and RREEF, a real-estate management business owned by Deutsche Bank (which owned the remaining 95%). DSMU/DSR’s goal was to redevelop the mall into a high-end retail, residential and office development similar to San Jose’s successful Santana Row.[10] Plans for the projected development, which would have included a movie theater, remain on the City of Sunnyvale’s website.[11]

DSMU/DSR took out a loan of $108.8 million from Wachovia Bank; Wachovia was later acquired by Wells Fargo.[12] By June 2009, DSMU/DSR defaulted on the loan. Peter Pau claims that the decision to default was made by RREEF without his consent.[12] After the default, Wells Fargo started foreclosure proceedings. A foreclosure auction in August 2011 attracted no bidders, so Wells Fargo took possession of the property itself.[1][10] The bank then attempted to sell the land to another developer, but this attempt was thwarted by a lawsuit from Pau.[12] Ever since, further development has been thwarted by the ongoing litigation between Pau and Wells Fargo. In May 2012, the City of Sunnyvale issued a press release accusing Pau of having filed “delaying lawsuits that have served little purpose other than to hold the project hostage”,[12][13] and claiming that “a nationally-recognized development team was set to come in and finish the project in 2011 … until the barrage of lawsuits blocked their entry”.[13] In February 2013, further appeals were filed by both Pau and Wells Fargo; Pau’s attorney estimated that the appeals would delay resolution of the case by at least two years.[14]

Current status

As of January 2015, the only active tenants of the downtown proper (apart from Target and Macy’s) are Apple and Nokia, which have occupied office space along Mathilda Ave.[14] The remaining retail and entertainment space is still under construction, and the residential units are unfinished.

On January 20, 2015, the California Court of Appeals, in an unpublished opinion, rejected one of Pau’s two appeals.[15] On May 19, the Court of Appeals rejected Pau’s remaining appeal.[16] Pau’s attorney stated that the developer was considering an appeal to the California Supreme Court.[17]

On August 12, 2015, the California Supreme Court declined to review the decision, effectively ending the litigation. The same day, Wells Fargo announced that it intended to sell the mall.[18]

Nearby developments

As of July 2013, one new restaurant has opened across from the BRE and Carmel Properties projects at the former Town and Country site. The apartments are scheduled to be available for occupancy by August 31, 2013. All other construction projects put on hold remain so, and all other residential units remain unfinished.

As of October 2013, one of the Solstice-BRE apartment sites has opened, and 2 restaurants and Japanese Relocation Center is set to open in 2014. More restaurants and retail locations are expected to be leased in the remaining space before the end of 2013. The second building is set to open in November 2013, and will begin leasing apartment units and retail/restaurant space soon after.

Across from the opened Solstice Building, Rokko, a Japanese restaurant, and NK Trends, a women’s clothing store, have opened, and 2 other restaurants (named Bambu and Bamboo) are set to open later in October. All other construction projects (on McKinley avenue and Taaffe street) are still on hold.

For more than four years, a high-profile legal fight over the ownership of Sunnyvale Town Center has kept the project in a state of half-built limbo. But that could soon change, as the apparent end of litigation clears the way for owner Wells Fargo to sell the massive mixed-use center to a developer who would finish the job.

On Wednesday, the California Supreme Court denied a request from Sand Hill Property Co. to revisit a California Court of Appeal decision issued in May. The Court of Appeal had rejected Sand Hill’s claims against Wells Fargo related to a 2011 lawsuit, which alleged a foreclosure auction of the center was not properly held.

Observers said that the Supreme Court’s denial is likely to end Sand Hill’s case against Wells Fargo, which has been one of the region’s longest-running real estate story lines and long a source of consternation for city officials.

The lifting of the legal cloud clears the way for a sale of the property to a developer who would complete the project. A Wells Fargo spokeswoman on Wednesday confirmed that Eastdil Secured, a subsidiary of Wells, had been retained to market the Town Center.

“We’re pleased with the court’s decision, which is a big step in paving the way for a potential sale,” Wells spokeswoman Elise Wilkinson said in an emailed statement. “We will consider offers from qualified buyers who will work with the City of Sunnyvale towards completing its vision for downtown.”

The state Supreme Court’s move does not end Sand Hill’s interest in the Town Center, on which the Menlo Park development firm served as the developer before the Great Recession. Wells Fargo foreclosed on most of the project in 2011 after RREEF Real Estate, Sand Hill’s financial partner in the development, allegedly walked away in 2009.

Peter Pau, founder of Sand Hill Property Co., told me on Wednesday that he remained interested in buying the project “for a fair price” so he could complete the project. (Pau has said throughout the ordeal that he would like to buy the project, but that Wells was not interested in selling to him.) Last year, Sand Hill snapped up the Macy’s building that is part of the Town Center project, a move that gave the developer some amount of control over future plans for the rest of the site.

“We need to finish what we started and do it properly,” Pau told me. “It’s not about ego or power or money. I have plenty of things going. I feel like this is something I started, and would like to have a chance to finish.

“That’s what the litigation was about — to let them know I would like a chance to buy it back,” he said. “I think I’m the most motivated person to get it done.”

Asked if Wells Fargo would sell to Sand Hill, the spokeswoman pointed me to the second part of her statement.

City officials hailed the news on Wednesday. The Town Center was to be the centerpiece of a revived downtown, boasting nearly two million square feet of commercial space and housing, including more than 900,000 square feet of retail and 300 housing units. While the city’s adjacent historic district, centered on Murphy Avenue, has thrived along with new apartment projects with ground-floor retail, the unfinished Town Center stands as an unsightly reminder of the recession.

In a news release, Mayor Jim Griffith said: “Today’s court decision is a long-awaited milestone that means our community can finally look forward to fully achieving its vision for downtown. The Town Center project is a very attractive centerpiece for development in Silicon Valley that will only add to our already thriving mix of shopping, restaurants and housing in the downtown.”

City Manager Deanna Santana said officials are working on a “market analysis” to review whether today’s marketplace still supports the original project’s vision. (Wells had previously asked city planners to consider increasing the office and residential space and decreasing the retail.)

“Our goal is to see this project come to fruition,” said Santana, in a statement, “so we have taken strategic actions and will continue to position Sunnyvale to realize the full potential of our downtown.”

What a buyer would get

A buyer would be acquiring a project approved for nearly 1.7 million square feet of total development, about 1.1 million of which is either completed or partially completed. While finishing it would require some work, it is a rare, ready-to-build large project — a block from Caltrain — in a region where finding sizable development sites is tough and getting approvals takes years.

Because of that, the offering is likely to attract significant interest from deep-pocketed investors, though the diversity of product type could also limit the buyer pool. Still, I’m hearing Wells would allow investors to acquire parts of the project as well as the whole thing.

The run-down includes:

- Two completed office buildings totaling 314,000 square feet and fully leased to Apple Inc. and Nokia through 2020

- 198 partially completed, for-sale residential condos in three buildings

- 245,000 square feet of retail that is partially complete

- a 105,000-square-foot theater building (with strong interest from both a national theater operator and a grocer)

- Two new parking structures already in use with about 2,765 stalls; a 967-stall parking structure that requires renovation; and surface parking lots totaling about 743 spaces

- Additional land approved for about 435,000 square feet of hotel, office, retail and residential

- Target and Macy’s are not part of the offering, but function as what’s called “shadow anchors” because they drives traffic to the rest of the project even though they are owned separately.