MULTIFAMILY RENTS HIT ALL-TIME HIGH

MULTIFAMILY RENTS HIT ALL-TIME HIGH

Jan 29, 2016

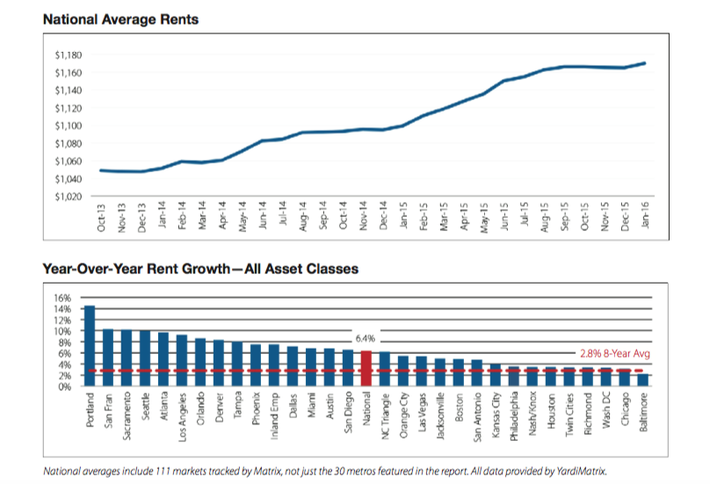

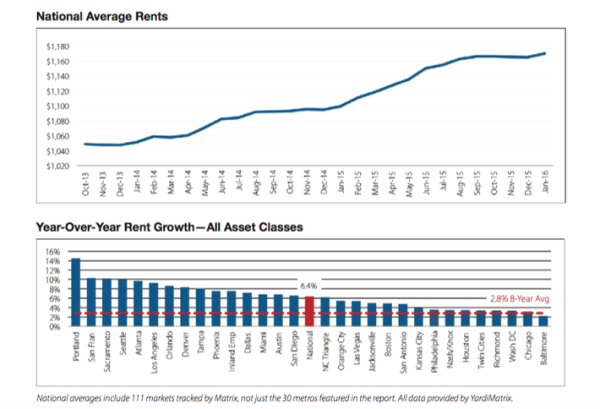

The multifamily rent market is off to a solid start this year: despite concerns that rent growth would cool off, the average national rental rate hit a record high of $1,170 in January, says market research firm Yardi Matrix. Yardi’s monthly report shows that multifamily rents rose $5 this month, surpassing the previous peak of $1,666 reached in September and October 2015. Nationally, rents were up 6.4% on a year-over-year basis. Leading the growth were metro markets on the West Coast and in the Southeast, including Portland, San Francisco, Seattle and Atlanta. At the other end of the spectrum, Baltmore, Chicago, and DC saw the smallest year-over-year growth.

The sharp drop in US stock—down about 10% this January—has raised fears that we may be headed toward a new economic recession. But Yardi analysts don’t expect the current economic turmoil to dampen rent growth in 2016; strong employment, tight vacancies and low ownership rates will continue to fuel demand for multifamily units, according to the report. “If recent economic history has taught us anything, it is that serious problems often start out as exogenous events that snowball into something larger,” the report says. “But for the time being, multifamily demand fundamentals and the capital markets are in good shape.”