A historically huge wave of new offices is about to crest in San Francisco

San Francisco will see more new office space in 2017 than at any time in the past three decades. More than 3 million square feet, including the city’s tallest new building, Salesforce Tower, will provide a big dose of new supply, twice the amount delivered in 2016.

Whether the city is thirsty for all that space remains to be seen.

Optimists point to the 40 percent of that pipeline that is already pre-leased, with heavy representation by the tech industry. Salesforce will occupy about half of its namesake, 1.4 million-square-foot tower. Tech companies Pinterest and Stripe have each fully leased a new building opening South of Market. Amazon.com’s gaming site Twitch has committed to about half of 350 Bush St., the only new tower arriving in the North Financial District.

“The market is still going to be predominantly tech-driven. The industry is still healthy,” said Colin Yasukochi, brokerage CBRE’s director of research in Northern California. “There’s still tech companies out there looking for space. It’s probably not as robust as it was in the last few years.”

Skeptics think that could be an understatement. The burst of space is almost certain to raise the vacancy rate in a market where rents have been largely flat for the last year and sublease space – typically a sign of a weakening market – was on the rise for most of 2016. So were landlord concessions like tenant improvement subsidies and free months of rent.

“Job creation is slowing by about half,” said Ken Rosen, chair of the University of California, Berkeley Haas Business School’s Fisher Center for Real Estate and Urban Economics. “The day of reckoning is coming.”

“Much of (San Francisco’s office space) has been pre-leased, but there’s still some of these large buildings that are not fully leased and if the economy slows at the same time that the buildings hit the market – the vacancy rate already edged up to about 8.4 percent from 6.8 percent — we could see it edge up further,” said Rosen.

The pause that refreshes?

Brokers (particularly those representing landlords) and developers tend to be optimistic by nature. A weakening of the economy in San Francisco could reflect a “pause after an overheated market over the past few years,” said Robert Sammons, regional research director at Cushman & Wakefield. But a flurry of deals in the fourth quarter, including two at new projects at 100 Hooper St. and 500 Pine St., demonstrate a continued demand for new developments.

“There is still a lot of need and desire for this new product,” said Sammons. That includ es companies expanding in San Francisco, as well as new tenants entering the market particularly from Silicon Valley.

Indeed, Cushman & Wakefield is tracking about 6 million square feet of tenant demand, up from about 4.5 million square feet of demand at the lowest point of 2016.

“We’re going to be seeing nice, steady growth,” said J.D. Lumpkin, managing principal and head of Cushman & Wakefield’s San Francisco office.

Also, developers of much of the new space, such as Boston Properties, Hines, Jay Paul Co. and Kilroy Realty Corp., tend to be long-term owners. Short-term vacancies aren’t likely to dent longer-term confidence.

Matt Lituchy, chief investment officer at Jay Paul Co., said while its project 181 Fremont St. hasn’t secured an office tenant, it is getting interest from both tech and non-tech companies. He sees little cause for concern.

“People are still hiring,” he said. “This region seems poised for continued growth. This is really a gateway city. That wasn’t the case seven, eight years ago.”

Turning off the taps

Mike Sanford, Kilroy’s vice president of Northern California, said the developer has commitments for all of the space at the 740,000-square-foot Exchange at 600 16th St., but no lease has been announced yet. The four-building complex can be configured as both traditional office space and lab space, which is scarce in the Mission Bay submarket.

Last quarter, Adobe leased 207,000 square feet at the nearby Kilroy’s 100 Hooper, jumpstarting construction.

Sanford said Kilroy Realty prefers building midrise projects with large floorplates, rather than towers.

The firm is also pressing ahead with an even bigger project, the 2.1 million-square-foot Flower Mart redevelopment in Central SoMa.

“The energy has been shifting south. The future will be Central SoMa and Mission Bay,” said Sanford.

In any case, the 2017 office burst will be short lived. Next year, the 1.1 million-square-foot Park Tower at 250 Howard St. will be completed, which will likely be San Francisco’s last major office project until 2021, when the 2 million-square-foot Oceanwide Center at First and Mission streets opens.

The city’s Prop. M restriction on office approvals may also limit future growth.

But even with vast political uncertainty, developers and brokers feel better about the economic compared to a year ago, when shakiness in the stock market led to some tech layoffs and a pullback in venture capital spending.

“We feel really, really good about the job growth, the regional economy,” said Chris Roeder, the international director of JLL marketing Park Tower.

Tough market for small tenants

The law firm Kelly, Hockel & Klein P.C. has been in San Francisco for 23 years. Jonathan Klein, president of the firm, has never seen an office market this challenging.

“In the old days, I used to compete against other law firms for space. Now I’m competing against Twitter and LinkedIn,” he said.

With its lease expiring this year, Klein and his firm looked in Berkeley, Oakland and Emeryville for a new office but couldn’t find suitable space.

The 10-person firm, which will be renamed Klein, Hockel, Iezza & Patel P.C. in February, ended up staying in San Francisco, but downsizing from 4,660 square feet at 44 Montgomery St. to 2,531 square feet at 455 Market St.

The firm will now be paying in the $60s per square foot, up from the mid-$40s in its current space, which it has occupied for three years.

The cost of building out space is prohibitive for smaller tenants, and landlords of new buildings are reluctant to divide up floors for them. That means they are usually looking at second-generation space, said broker Tony Zucker of Dunhill Partners West, who represented Kelly, Hockel & Klein P.C. in the lease.

Without the robust growth of the technology industry and venture capital backing, law firms, as well as the financial services sector and other traditional tenants, have been downsizing, consolidating space or moving employees to the East Bay or out of the region.

“I don’t think there’s a great growth in our business line. It’s largely the same total of law firms,” said Klein.

Todd Rufo, director of the city’s Office of Economic and Workforce Development, said that the adding new office space would help create more options for tenants, but the city is also working to help businesses and especially nonprofits stay.

“Scarcity drives up prices,” he said. “We want to ensure there’s a range of product available in the city.

The Exchange

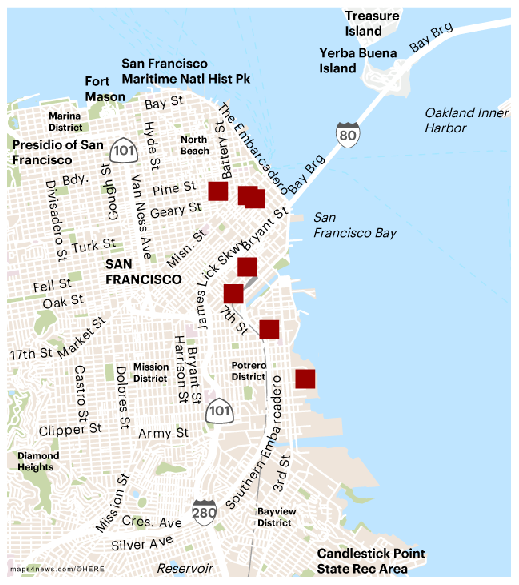

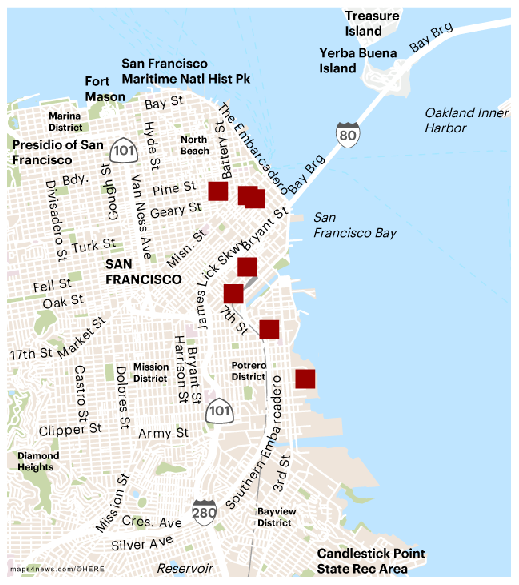

Location: 600 16th St.

Size: 740,000 square feet among four buildings

Developer: Kilroy Realty Corp.

Architects: Flad Architects, Rios Clementi Hale Studios

General Contractor: Hathaway Dinwiddie

Brokers: CBRE, Kidder Matthews

Cost:$450 million

181 Fremont

Location: 181 Fremont

Size: 435,000 square feet of office and 67 condos

Developer: Jay Paul Co.

Architect: Heller Manus

General Contractor: Level 10 Construction

Broker: Newmark Cornish & Carey

Cost:$640 million

Pier 70 Renovation

Location: 420 22nd St

Size: 300,000 square feet

Tenants: Restoration Hardware, Tea Collection

Developer: Orton Development

Architect: Marcy Wong Donn Logan

General Contractor: Nibbi Brothers General Contractors

Broker: Cushman & Wakefield

Cost:$100 million

350 Bush

Location: 350 Bush

Size: 360,000 square feet

Tenant: Twitch

Developers: Lincoln Property Co., Gemdale

Architect: Heller Manus

General Contractor: Hathaway Dinwiddie

Broker: CBRE

Cost:$110 million

Salesforce Tower

Location: 415 Mission St.

Size: 1.4 million square feet in 61 stories

Tenants: Salesforce.com, Bain & Co.

Developers: Boston Properties, Hines

Architect: Pelli Clarke Pelli

General Contractor: Clark/Hathaway Dinwiddie

Broker: CBRE

Cost:$1.1 billion

510 Townsend

Location: 510 Townsend

Size: 300,000 square feet

Tenants: Stripe

Developer: Alexandria Real Estate Equities

Architect: Studios Architecture

General Contractor: DPR Construction

505 Brannan

Location: 505 Brannan

Size: 150,000 square feet

Tenants: Pinterest

Developer: Alexandria Real Estate Equities, TMG Partners

Architect: Heller Manus

General Contractor: Swinerton