Real Estate Outlook 2/4

U.S. Outlook

Presidential Election Brings a Broader Range of Potential Risks and Rewards

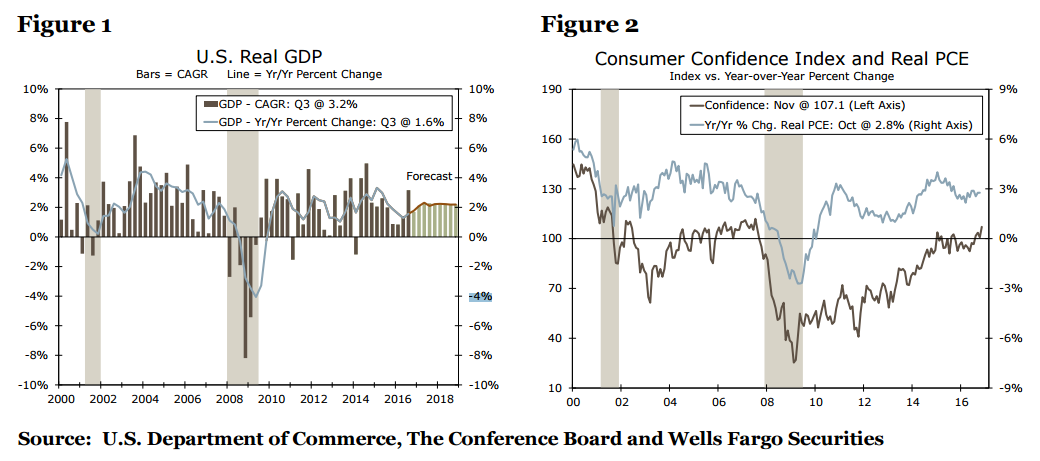

Donald Trump’s surprising presidential election win throws a curveball into what was going to be a run-of-the-mill 2017 economic outlook. The probability distribution of potential outcomes is now greater than it otherwise would have been. Underlying aggregate demand has been consistently growing at around a 2 percent pace since the recession ended. Complacency had set in for decision makers. This past year should see growth slow further to just a 1.5 percent pace as fallout from the energy slump and slower economic growth overseas weighed on capital goods producers and exports (Figure 1). Even with a slowdown in real GDP growth, employment growth remained steady and the unemployment rate looks like it will end the year below 5 percent.

With the return of full employment, monetary policy was already expected to become less stimulative. The probability of progressively less stimulative monetary policy is now higher. Fiscal policy is also now likely back in play, particularly given that Trump will begin his term with both houses of Congress in Republican control, which will mark the first time a single-party had control since 2010 and the first Republican single-party control since 2006.

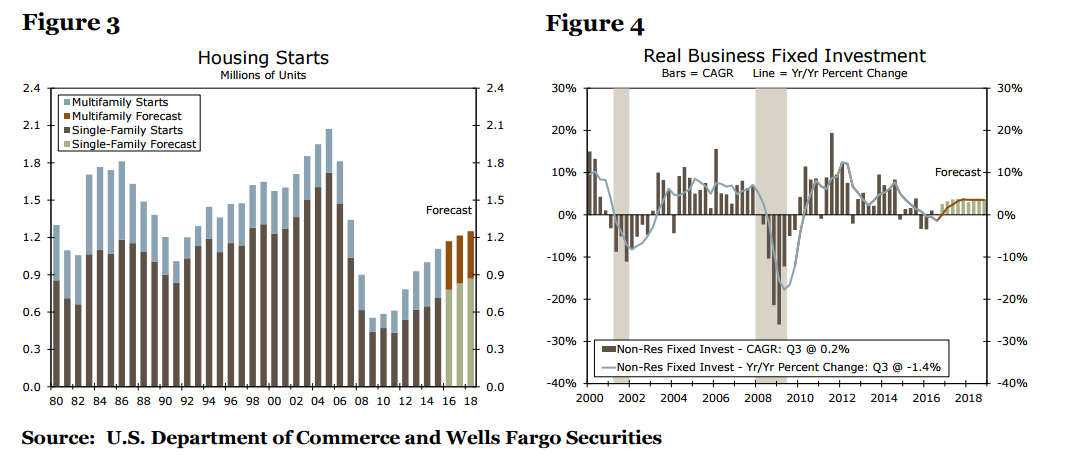

In keeping with our theme of risk and reward in an aging business cycle, the policy shift could be seen as coming at an opportune time. Consumer spending has showed signs of firming in recent months and confidence is at the highest levels of the present cycle (Figure 2). Still, higher costs for out-of pocket health care expenditures are reducing discretionary spending, as is evident in recent weakness in the restaurant sector. One risk is that this weakness will spread and intensify as household budgets are crimped further by steep increases in health insurance costs that kick into effect at the start of 2017. Energy prices have stabilized as the OPEC meeting resulted in agreements to scale back production enough to support higher prices. As of this writing, both Brent and WTI oil prices are just above $50/barrel. We continue to look for energy prices to firm over the forecast horizon, but crude oil inventories remain historically high and OPEC is producing well over its stated limits, making such a forecast far from certain. If prices were to hold near their current level, the energy sector would benefit considerably. Break-even prices for oil production have fallen considerably as the industry has become much more efficient.

Should they occur, the combination of potential tax cuts, reduced regulation and increased federal government spending for defense and infrastructure would keep employment and income growing at a solid pace, although it also raises some concerns about pushing wages up a bit more rapidly. The timing of big fiscal policy measures like infrastructure programs coming when the economy is at or near full employment could stoke inflation. Such a development is not necessarily a bad thing, particularly given how hard policy makers have been striving for that outcome. Fed Chair Janet Yellen and other Federal Reserve officials have discussed the merits of allowing the labor market to run a little hot for a while. The Fed’s thinking is that although the unemployment rate has fallen back near levels consistent with full employment, considerable slack remains in the labor market due to underemployment and the persistent drop in the labor force participation rate over the past few decades.

Stronger job and income growth should keep consumer spending on a solid trajectory. We look for real personal consumption expenditures to rise at a 2.6 percent pace in 2017. Moreover, we look for auto sales to total 17.0 million units in 2017, which will help drive durable goods purchases higher. Real spending on services, which accounts for nearly two-thirds of consumer spending, should rise 2.1 percent.

Our outlook for the housing market remains cautious. Sales of single-family homes lost momentum this past summer, as tight inventories have pushed home prices higher. The shock to affordability is apparent in major surveys of home buying intentions, including the monthly University of Michigan Consumer Sentiment Survey and the Fannie Mae Home Purchase Sentiment Survey. Rents for apartments have also become increasingly less affordable, particularly in rapidly growing metropolitan areas. We expect homebuyers and renters to see some modest relief in 2017 as construction shifts more toward less-expensive suburban homes and apartments. This shift is already apparent in the construction spending data, which have shown a persistent slide in residential construction expenditures.

Rising mortgage rates may present a bit of a challenge in 2017 and 2018. With interest rates as low as they currently are, even a modest half percentage point rise in mortgage rates, coupled with a 4 percent rise in home prices, would send monthly principle and interest payments up by nearly 10.5 percent. These increased costs, however, would likely be offset by a better mix of homes available for sale, including more affordable, entry-level homes, and some easing of mortgage qualification requirements. Demographics will also turn more favorable, as more Millennials reach a point in their lives where they are forming a family and looking to buy a home. We look for housing starts to rise 4 percent in 2017 and 3 percent in 2018, with nearly all of the gains coming from single-family starts (Figure 3).

Business fixed investment is expected to improve modestly, as the drag from energy-related cutbacks wanes (Figure 4). After falling in five of the past six quarters, equipment spending is expected to pick up in 2017. Increased equipment purchases are also needed to bolster productivity and offset rising wage and benefit costs, as well as to replace harder-to-find workers. Manufacturing employment has been spotty in recent months, but this may reflect the skills mismatch and employers having difficulty finding qualified labor. Outside the construction sector, manufacturing has seen the biggest increase in job openings according to the Job Openings and Labor Turnover Survey (JOLTS). Lower corporate tax rates, should they occur, and a dialing back of regulation could also help drive investment in new plants and equipment. Investment in the energy sector would be a major beneficiary of this shift, as higher prices boost exploration and production and regulatory reforms allow for more investment in pipelines and other energy infrastructure.

We look for inventories to add only modestly to GDP growth. While stocks are likely to increase in line with final demand, inventories are still high relative to shipments so this increase will be modest, particularly as businesses may be reluctant to stock up too much this late in the business cycle. Trade will likely remain a drag for overall growth, as sluggish growth overseas and a stronger dollar restrain exports, while modest domestic growth continues to pull in imports.

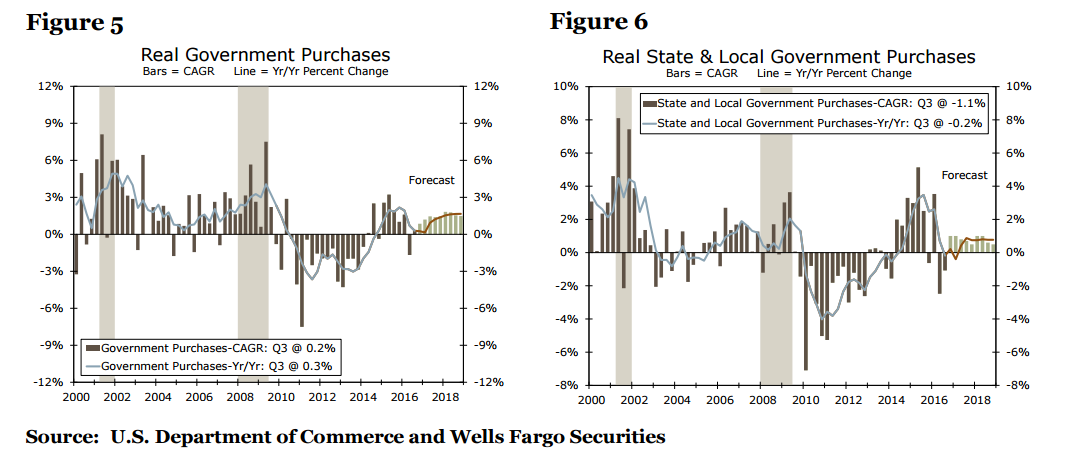

Total government spending fell short of expectations in 2016, and likely rose just 0.8 percent following a 1.8 percent rise in 2015 (Figure 5). The drag from federal fiscal policy changes enacted back in 2011 and modified in 2013 and again in 2015, began to diminish this year as Congress back-filled some of the planned budget cuts. While federal investment and spending picked up, state and local governments began to experience more modest revenue growth and growing pressure from pension liabilities and increasing costs associated with the expansion of the Medicaid program under the Affordable Care Act. State and local spending and investment is expected to rise just 0.8 percent this year after climbing 2.9 percent in 2015. Of greater concern is the slowing momentum among state and local government spending, which averaged just 0.2 percent in the second half of this year (the first half of the 2017 fiscal year for most states).

Combined, federal and state and local spending should expand 0.9 percent in 2017. Our expectation is that federal fiscal policy will become slightly more expansionary in 2017. With the White House and Congress both in Republican hands, tax cuts look far more certain this year and budget constraints on defense spending will likely be reduced. Thus, federal spending and investment is expected to rise 1.9 percent in 2017. State and local governments will continue to be challenged by a slower pace of revenue growth from sales and income tax collections, while, at the same time, facing increasing budget pressure from growing pension liabilities and rising costs associated with expanded healthcare coverage. Our expectation is for state and local spending and investment, the largest component of government spending, to slow to just 0.4 percent 2017 (Figure 6), restraining total government spending’s contribution to GDP growth next year.

The average length of an expansion in the post-war economy is just under five years (58.4 months according to the National Bureau of Economic Research’s (NBER) business cycle dating committee). The current expansion will be seven and a half years old at the start of 2017. The longest expansion in American history was a 10-year stretch in the 1990s. That means that President Trump will either preside over a recession or the longest uninterrupted expansion on record. In October, our full-year GDP forecast was 2.2 percent for 2017 and 2.2 percent for 2018. Post-election, those figures are unchanged. Keeping with our theme of balancing risk and reward in an aging business cycle, the big impact from the election is less about the actual projected growth rate we have forecasted and more about the increased variability of potential outcomes given increased policy uncertainty.

20161208