Unicorns 6/229–Palantir Technologies

PALANTIR TECHNOLOGIES

Founders Peter Thiel, Nathan Gettings, Joe Lonsdale, Stephen Cohen, Alex Karp

Key people: Peter Thiel (Chairman), Alex Karp (CEO)

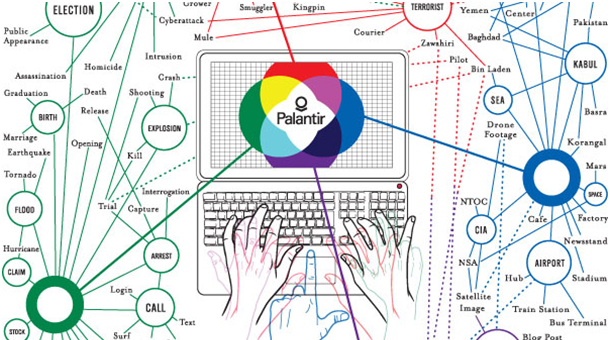

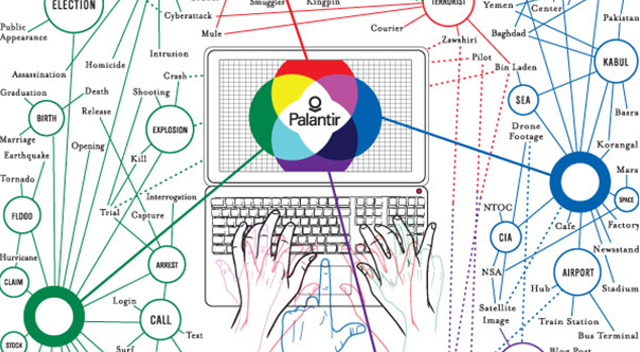

Palantir Technologies, Inc. is a private American software and services company headquartered in Palo Alto, California which specializes in big data analysis. The company is known for two projects in particular: Palantir Gotham and Palantir Metropolis. Palantir Gotham is used by counter-terrorism analysts at offices in the United States Intelligence Community (USIC) and United States Department of Defense, fraud investigators at the Recovery Accountability and Transparency Board, and cyber analysts at Information Warfare Monitor, while Palantir Metropolis is used by hedge funds, banks, and financial services firms.

Founded in 2004 by Peter Thiel, Nathan Gettings, Joe Lonsdale, Stephen Cohen and Alex Karp, Palantir’s original clients were federal agencies of the USIC. It has since expanded its customer base to serve state and local governments, as well as private companies in the financial and healthcare industries. Alex Karp, Palantir’s chief executive officer, announced in 2013 that the company would not be pursuing an IPO, as going public would make “running a company like ours very difficult”.

The company was valued at US$9 billion in early 2014, with Forbes stating that the valuation made Palantir “among Silicon Valley’s most valuable private technology companies”. As of December 2014, Peter Thiel was Palantir’s largest shareholder. In January 2015, the company was valued at US$15 billion after an undisclosed round of funding with US$50 million in November 2014. This valuation rose to US$20.33 billion in late 2015 as the company closed an $880 million round of funding.

History

2003–2008: Founding and early years

Though usually listed as having been founded in 2004, SEC filings state Palantir’s official incorporation to be in May 2003 by Peter Thiel (co-founder of PayPal), who named the start-up after the “seeing stone” in Tolkien’s legendarium. Thiel saw Palantir as a “mission-oriented company” which could apply software similar to PayPal’s fraud recognition systems to “reduce terrorism while preserving civil liberties.”

In 2004, Thiel bankrolled the creation of a prototype by PayPal engineer Nathan Gettings and Stanford University students Joe Lonsdale and Stephen Cohen. That same year, Thiel hired Alex Karp, a former colleague of his from Stanford Law School, as chief executive officer.[9][10]

Headquartered in Palo Alto, California, the company initially struggled to find investors. According to Karp, Sequoia Capital chairman Michael Moritz doodled through an entire meeting, and a Kleiner Perkins Caufield & Byers executive lectured the founders about the inevitable failure of their company. The only early investments were $2 million from the U.S. Central Intelligence Agency’s venture capital arm In-Q-Tel, and $30 million from Thiel himself and his venture capital firm, Founders Fund.

Palantir developed its technology by computer scientists and analysts from intelligence agencies over three years, through pilots facilitated by In-Q-Tel. The company stated computers alone using artificial intelligence could not defeat an adaptive adversary. Instead, Palantir proposed using human analysts to explore data from many sources, called intelligence augmentation.

2009: GhostNet and the Shadow Network

In 2009 and 2010 respectively, Information Warfare Monitor used Palantir software to uncover the GhostNet and the Shadow Network. The GhostNet was a China-based cyber espionage network targeting 1,295 computers in 103 countries, including the Dalai Lama’s office, a NATO computer and various national embassies. The Shadow Network was also a China-based espionage operation that hacked into the Indian security and defense apparatus. Cyber spies stole documents related to Indian security and NATO troop activity in Afghanistan.

2010–2012: Expansion

In April 2010, Palantir announced a partnership with Thomson Reuters to sell the Palantir Metropolis product as QA Studio. On June 18, 2010, Vice President Joe Biden and Office of Management and Budget Director Peter Orszag held a press conference at the White House announcing the success of fighting fraud in the stimulus by the Recovery Accountability and Transparency Board (RATB). Biden credited the success to the software, Palantir, being deployed by the federal government. He announced that the capability will be deployed at other government agencies, starting with Medicare and Medicaid.

Estimates were $250 million in revenues in 2011.

2013–2016: Additional funding

In September 2013, Palantir disclosed over $196 million in funding according to a U.S. Securities and Exchange Commission filing. It was estimated that the company would likely close almost $1 billion in contracts in 2014. CEO Alex Karp announced in 2013 that the company would not be pursuing an IPO, as going public would make “running a company like ours very difficult.” In December 2013, the company began a round of financing, raising around $450 million from private funders. This raised the company’s value to $9 billion, according to Forbes, with the magazine further explaining that the valuation made Palantir “among Silicon Valley’s most valuable private technology companies.”A document leaked to TechCrunch revealed that Palantir’s clients as of 2013 includ ed at least twelve groups within the U.S. government, including the CIA, DHS, NSA, FBI, CDC, the Marine Corps, the Air Force, Special Operations Command, West Point, the Joint IED-defeat organization and Allies, the Recovery Accountability and Transparency Board and the National Center for Missing and Exploited Children. However, at the time the United States Army continued to use its own data analysis tool. Also, according to TechCrunch, the U.S. spy agencies such as the CIA and FBI were linked for the first time with Palantir software, as their databases had previously been “siloed.”

In December 2014, Forbes reported that Palantir was looking to raise $400 million in an additional round of financing, after the company filed paperwork with the Securities and Exchange Commission the month before. The report was based on research by VC Experts. If completed, Forbes stated Palantir’s funding could reach a total of $1.2 billion. As of December 2014, the company continued to have diverse private funders, Kenneth Langone and Stanley Druckenmiller, In-Q-Tel of the CIA, Tiger Global Management, and Founders Fund, which is a venture Firm operated by Peter Thiel, the chairman of Palantir. As of December 2014, Thiel was Palantir’s largest shareholder.

The company was valued at $15 billion in November 2014. In June 2015, Buzzfeed reported the company was raising up to $500 million in new capital at a valuation of $20 billion. By December 2015, it had raised a further $880 million, while the company was still valued at $20 billion. In February 2016, Palantir bought Kimono Labs, a startup which makes it easy to collect information from public facing websites.

In August 2016, Palantir acquired data visualization startup Silk. Its UK based data mining startup Gray Havens is the central point for the European expansion of the company.