Google’s Smartphone Conundrum

The Pixel problem

On Wednesday, Google (GOOG, GOOGL) held a launch event which introduced a number of new hardware products. The centerpiece of the event was, of course, the launch of the new Pixel 2 and Pixel 2 XL smartphones.

The phones appear to be worthy successors to the Pixel phones of last year. They feature Qualcomm (NASDAQ:QCOM) Snapdragon 835 processors, and the Pixel 2 has already unseated the iPhone 8 Plus as the best smartphone camera DXOMark has tested.

Based on early impressions, the Pixel 2 XL appears to be the phone to buy. It has a larger, nearly edge-to-edge OLED screen and is made by LG (OTC:LGEAF). And Google’s new Pixel phones are the first smartphones to ship with Android 8.0.

The company shows every intention of pursuing the Apple (NASDAQ:AAPL) model of controlling both the hardware and software designs of its smartphones. Towards that end, it acquired a part of HTC’s mobile device team for $1.1 billion, along with a non-exclusive license for HTC intellectual property.

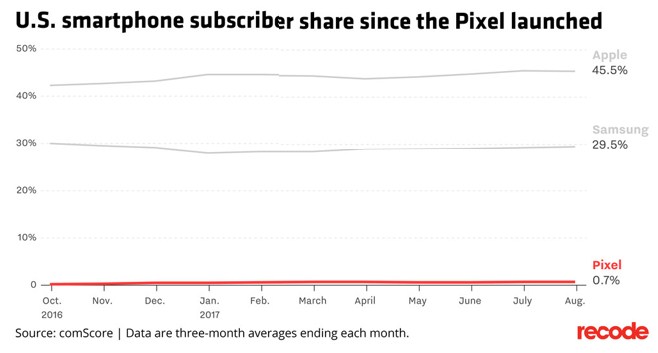

Having intimate knowledge and control of Android, Google should be able to create Android smartphones that are differentiated from the products of its Android OEMs. But there’s a problem, and this problem is illustrated by the following graph courtesy of Recode and comScore:

Pixel’s usage share (not market share) in the US is just 0.7%, or about 1.32 million users. That Google only sold 1.32 million Pixel phones through August in the US since launch is actually rather startling.

Having your cake and eating it too

Google’s problem is what I call the “having your cake and eating it too” problem that we have seen in the case of Microsoft (NASDAQ:MSFT) and even Google after it acquired Motorola. The company has very successfully applied the commodity licensing model to Android. This is similar to the licensing model of Windows, except that Google has gone a step further by making Android nearly free for its OEM partners.

The commodity licensing model has worked wonderfully for Android by virtue of monetization through advertising and Google services such as search. The marketing of premium, Google-branded hardware attempts to emulate the Apple model without first dismantling the commodity side of the business, which is not a part of the Apple model.

The problem with this is that a company such as Google or Microsoft simply ends up competing with its OEMs. Microsoft’s Surface devices compete with Windows OEMs. Google’s Pixel smartphones compete with Android OEMs.

Android OEMs such as Samsung (OTC:SSNLF) have built on their high-volume commodity business in order to move up market with devices such as the Galaxy S8 and Note 8. The high end of the Android market is already fairly crowded with devices from Samsung, Huawei, HTC (OTC:HTCKF) and LG, not to mention Xiaomi, OPPO and vivo in the mid-tier.

This is the conundrum that Google faces. I wouldn’t go so far as to say that it can’t compete effectively, but the “have your cake and eat it too” strategy hasn’t really worked so far for anyone. Furthermore, to the extent that it might work in the future for Google, it would probably come at the expense of the OEMs, and thus, it’s a zero sum game.

What’s the motivation?

So why does Google want to do this? It’s been argued that the company doesn’t have to succeed in hardware. True, but in that case, why is it trying so hard? Building smartphones is not a moon shot project like autonomous vehicles. Google’s key differentiator for consumers will be its ability to speed OS updates to its phones before the OEMs.

The best explanation I can come up with is that it’s insurance for when, or if, the advertising model starts to break down. There are already plenty of signs of stress. The Safari browser for iOS and macOS now implements blocking of auto-start video ads (a great relief, I might add), and the newest version also blocks cookie tracking, to the consternation of the advertising industry.

Ad blocking add-ons for web browsers have become increasingly popular. So much so that even Google has announced that Chrome will soon block certain types of online ads that don’t conform to its standards.

Thus far, it doesn’t appear that ad blocking has hurt the company’s ad revenue, but the effect of ad blocking may be seen in other ways, such as the ever-declining cost per click. I don’t expect that ad blocking will ever eliminate web-based advertising, but it may well make it much less valuable to advertisers.

Web-based content delivery, whether news or video, is increasingly becoming bifurcated into subscription and ad-supported services. Subscription services are winning the high end of the content delivery market, while ad-supported sites and services increasingly occupy a lower tier of content quality and audience income level. As this process continues, it’s possible that the company foresees a bleak future for online advertising.

Or maybe Google really thinks the Apple model and the commodity OEM model can coexist within a single business entity like Alphabet.

Apple and Qualcomm are part of the Rethink Technology Portfolio and are recommended buys.