Best Mortgage Lenders of 2020 – 1/10 – Bank of America

Best Mortgage Lenders of 2020 – 1/10 – Bank of America

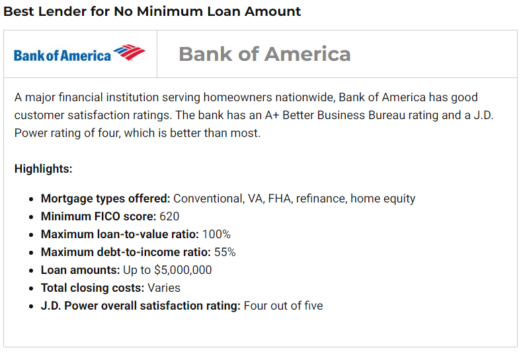

Best Lender for No Minimum Loan Amount

https://smartasset.com/mortgage/bank-of-america-mortgage-rates

With a plethora of mortgages to choose from, it’s no surprise that Bank of America is one of nation’s largest mortgage lenders. The bank has a selection of multiple fixed-rate mortgages, variable-rate mortgages, jumbo mortgages and the Affordable Loan Solution® mortgage that offers low down payments.

Bank of America’s interest rates aren’t anything incredible, but they’re typically slightly better than, or right in line with, average mortgage rates across the U.S. You’ll also be able to get a Bank of America mortgage and have access to in-person customer service in any of the 50 states and Washington, D.C.

Overview of Bank of America Mortgages

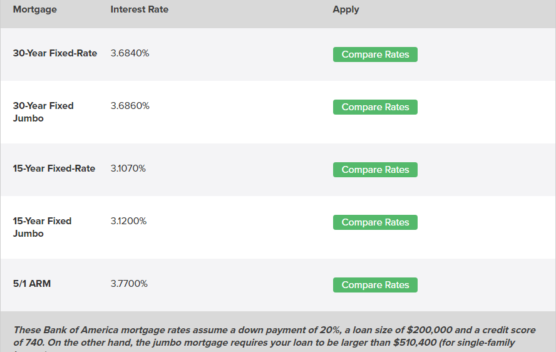

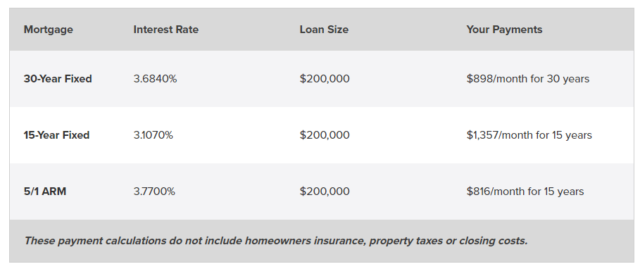

Like many lenders, Bank of America’s most popular loans are its fixed-rate conventional mortgages. These are generally the most reliable loans, as you’re locked into a pre-specified rate that allows you to know exactly what your payments will be each month.

Bank of America offers these mortgages in 15-, 20- and 30-year terms, affording you flexibility in how long you want to take to pay off your home. Although shorter-term loans allow you to save significantly on interest, you will then be subject to larger monthly payments. But if you can afford these heftier bills, it’s well worth doing.

Jumbo loans are exactly what they sound like: a sizable loan for those that are likely looking to purchase a more expensive home. The exact amount that a mortgage must break in order to be considered “jumbo” was set by Freddie Mac and Fannie Mae, and currently sits at $510,400. Jumbo mortgages sometimes come with higher interest rates than their fixed-rate counterparts, but that’s not always the case, and they can come as either a fixed-rate or adjustable-rate mortgage (ARM).

An ARM is a loan that includ es a variable interest rate that will shift over time. These alterations aren’t random, as Bank of America makes changes based on an index called the London Interbank Offered Rate, or LIBOR. However, all ARMs come with an initial payment period that utilizes a lower fixed-rate that makes these a great choice for people with less money to spend now than they will have in the future. When it comes to Bank of America, the shorter the opening period, the better the rate you’ll receive.

At Bank of America, there are three different types of ARMs: a 10/1 ARM, a 7/1 ARM and a 5/1 ARM. The first number in each refers to the number of years the loan will remain at a fixed-rate. Following that, though, your interest rate will be amended every year based on the LIBOR market index.

For those who may find it difficult to muster a large enough of a down payment for a typical mortgage, Bank of America offers the Affordable Loan Solution® mortgage. You may even be eligible for a down payment as little as 3% of the value of your home. These come in either 25- or 30-year terms and are fixed-rate loans. If you already own property, either independently or jointly, you will not be eligible to receive an Affordable Loan Solution® mortgage.

You can also apply for VA loans and FHA loans with Bank of America. An FHA loan is insured by the Federal Housing Administration and is available for low-income households that typically either have little money for a down payment and/or a low credit score. A VA mortgage, as you might expect, is reserved for past and present military members who also have low funding for a down payment.