Best Mortgage Lenders of 2020 – 4/10 – Guild Mortgage Co.

Best Mortgage Lenders of 2020 – 4/10 – Guild Mortgage Co.

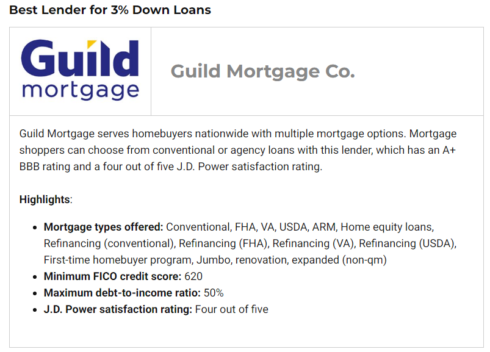

Best Lender for 3% Down Loans

What Kind of Mortgage Can I Get With Guild Mortgage?

Guild Mortgage prides itself on the wide range of residential mortgage products it offers. The company has experience in several specialized loan programs.

Fixed-rate mortgage: With a fixed-rate mortgage, you lock in your mortgage interest rate for the life of the loan. Your principal and interest payment won’t change throughout the course of your term. Guild offers terms ranging from 10 to 30 years. Single family loans can go up to the conforming amount ($424,100 as of 2017) and down payments can be as low as 3%, depending on financial factors and specialized programs. This type of loan can be best for those planning to keep the home for a long period of time.

Adjustable-rate mortgage: Unlike fixed-rate loans, your interest rate will change in one-year periods following the initial term with adjustable-rate mortgages (ARMs). Guild recommends these mortgages for homebuyers planning to move or refinance in five – 10 years. The company offers ARM loans with three-, five-, seven- or 10-year initial fixed-rate periods. After the agreed time period is up, the mortgage rate will change. This type of loan has the lowest interest rates initially. Guild requires a minimum FICO score of 640 to qualify.

Jumbo loan: For home purchases over $424,100 (in most areas), Guild offers fixed-rate or adjustable-rate jumbo loans. Guild advises that only borrowers with excellent credit and strong assets consider this type of loan. Jumbo loans are considered non-conforming loans and exceed Fannie Mae and Freddie Mac guarantee amounts. This means Guild Mortgage has to secure the loan itself, which means stricter requirements for borrower finances.

Federal Housing Administration (FHA) loan: As a government-backed loan, FHA loans are available to many first-time homebuyers and people with low-to-moderate incomes. Down payments can be as low as 3.5% with this type of loan. FHA loans do come with some government requirements, such as mortgage insurance. This type of loan is available as a fixed-rate or adjustable-rate mortgage. If you have limited funds, a low income and a lower credit score, this may be the mortgage option available for you.

USDA loan: The U.S. Department of Agriculture (USDA) backs this type of loan for borrowers in rural or underdeveloped areas. You may be eligible for a USDA loan if the property is in a designated rural area and your household has a low or moderate income. Features of this type of loan includ e zero down payment options as well as lower rates and fees than other loan programs.

VA loans: This loan is designed for current or former member of the U.S. Armed Forces, National Guard, Reserves and select spouses. As a government-backed mortgage, this loan comes with some advantages including zero down payment options and lower rates than other programs.

Guild 1% Down loans: This unique down payment assistance program allows borrowers to pay just 1% down. Guild will cover 2% and you can get a mortgage with a total of 3% down. You don’t have to pay back Guild, the 2% is yours free with the loan. You’ll need a minimum FICO credit score of 680 to qualify and the program is not just for first-time homebuyers. However, a homeownership education course is required for this option. In addition, you will need mortgage insurance with this loan as it’s below the recommended 20% down payment, but it is cancellable and reduced with this program.

Refinance: If you’re hoping to refinance your mortgage for a lower interest rate or new mortgage term, Guild Mortgage offers refinances. Guild does not offer as much information regarding refinance options on its website as it does for other mortgage options, so you’ll have to contact a loan officer to discuss your situation.