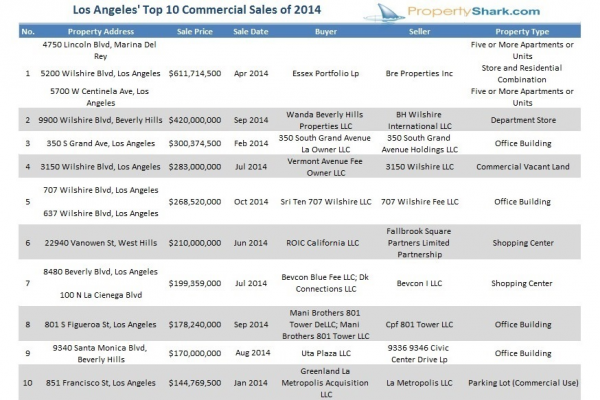

Los Angeles’ Top 10 Most Expensive Commercial Real Estate Deals of 2014

Determined to capitalize on the strong demand for both residential and commercial properties, many investors have turned their attention to L.A., with the top 10 largest commercial transactions by value totaling almost $3 billion last year.

As compiled by PropertyShark, here are Los Angeles’ top 10 most expensive commercial real estate deals of 2014.

#10. 851 Francisco St, Los Angeles

Price: $144,769,500

Chinese real estate developer Greenland Group has made it to our top 10 list with its acquisition of a parking lot along the 110 Freeway in downtown Los Angeles. The company paid almost $150 million for the parcel and plans to construct a high-rise mixed-use complex that is destined to redefine the downtown Los Angeles skyline.

Dubbed Metropolis Los Angeles, the high-end complex will include upscale residences, a 350-room hotel as well as a thoughtfully curated collection of retail and dining space.

#9. 9340 Santa Monica Blvd, Beverly Hills

Price: $170,000,000

The Rockefeller Group acquired a premier 236,000-square-foot office building portfolio on Civic Center Drive in Beverly Hills from Tishman Speyer.

Known as The Ice House and UTA Plaza, the complex houses tenants such as Playboy Enterprises, United Talent Agency, and the Live Nation Worldwide headquarters.

#8. 801 S Figueroa St., Los Angeles

Price: $178,240,000

Next on our list is 801 Tower, a state-of-the-art Class A office building located at 801 South Figueroa Street in the financial corridor of Downtown Los Angeles.

Mani Brothers Real Estate Group sold the tower to Cornerstone Real Estate Advisers LLS, which shelled out $178 million for the property. This resulted in a cost of about $386 per square foot. Built in 1991, the property features three subterranean parking levels and ground-floor retail space.

#7. 8480 Beverly Blvd, 100 N La Cienega Blvd, Los Angeles

Price: $199,359,000

In the 7th spot on the list was the purchase of properties at 8480 Beverly Blvd. and 100 N. La Cienega Blvd. for just under $200 million. Situated between Vanowen Street and Victory Boulevard in West Hills, this 880,000-square-foot open-air shopping center offers a nice variety with such retailers as Kohl’s, Wal-Mart, Target, Home Depot, Trader Joe’s, and Petco.

#6. 22940 Vanowen St, West Hills

Price: $210,000,000

Retail Opportunity Investments Corp. (ROIC) has acquired Fallbrook Shopping Center, a well-positioned shopping center that serves the West San Fernando Valley.

The 1.12 million-square-foot property was purchased for a total of $210 million in cash.

#5. 707 Wilshire Blvd, 637 Wilshire Blvd, Los Angeles

Price: $268,520,000

Shorenstein Properties took home the prize for the 5th most expensive commercial deal when it acquired two properties located on Wilshire Boulevard, both office buildings, for a total price of $268,520,000. Among the two properties purchased was AON Center, a 62-story tower at 707 Wilshire Blvd. Built in 1973, the tower remained the tallest building in the Los Angeles area for several years.

Also included in the purchase was 637 Wilshire Blvd., a property that has been somewhat overshadowed by nearby skyscrapers due to its unassuming height and black glass panel façade. Among the most interesting features of this property is the fact that it connects to the much statelier 707 Wilshire Blvd., better known as Aon Center, via an underground tunnel.

#4. 3150 Wilshire Blvd, Los Angeles

Price: $283,000,000

In one of last year’s biggest deals, a partnership of Capri Capital Partners, LLC and TruAmerica Multifamily, LLC has purchased a newly-built, 464-unit high-rise apartment complex in the Koreatown area of Los Angeles.

This high-end multifamily project, dubbed the Vermont, features entire block frontage along Wilshire and includes 31,000 square feet of retail space.

#3. 350 S Grand Ave, Los Angeles

Price: $300,374,500

One of the most expensive office building purchases in Los Angeles in 2014 was the acquisition of Two California Plaza by CIM Group, which paid slightly over $300 million for the 52-story office building.

Designed by Arthur Erickson Architects, this blue glass structure is one of the most prominent landmarks in downtown Los Angeles and was named BOMA Building of the Year twice.

#2. 9900 Wilshire Blvd, Beverly Hills

Price: $420,000,000

Occupying the second-place position for the largest commercial real estate transactions in Los Angeles was the purchase of 9900 Wilshire Blvd. in Beverly Hills, by Wanda Beverley Hills Properties. The Chinese mega-developer paid just over $420 million to BH Wilshire International for the department store site.

Wanda Group says it plans to invest about $1.2 billion to redevelop the site and turn it into a world-class mixed-use project, predominantly featuring luxury residential condominium units. Design plans for the condominiums were completed by architect Richard Meier.

Groundbreaking is set for 2015.

#1. 4750 Lincoln Blvd, Marina Del Rey, 5200 Wilshire Blvd, Los Angeles, 5700 W Centinela Ave, Los Angeles

Price: $611,714,500

Last year’s most expensive commercial deal was the merger of BRE Properties, Inc. and Essex Property Trust, Inc. The transaction, which totaled more than $600 million, involved the purchase of three separate properties.

“We are excited to consummate the merger and move forward to combine these two great organizations to form the leading West Coast multifamily REIT,” said Michael Schall, President and CEO of Essex, in a statement. “The integration effort is proceeding as planned, which we believe will result in a stronger platform for sustainable growth, superior service for our residents, and expanded career opportunities for our employees. I want to thank the employees of both companies for their hard work, dedication and support.”

Overall, the Los Angeles real estate market performed exceptionally well in 2014, with a net gain in office occupancy of 3.8 million square feet, according to the Los Angeles Times.