The US Real Estate Forecast 2018 to 2020

The US Real Estate Forecast 2018 to 2020

Experts predictions are mostly rosy forecasts of most markets from Los Angeles and San Diego to New York. It’s happy times for sellers but tough shopping for home buyers and investors.

Most real estate sales and real estate investment experts are predicting a strong year ahead for US housing in 2018 for the next 5 years. This post has numerous insightful charts, videos and perspectives to help you understand the housing market in 2018 and beyond.

In some markets, home prices continue their relentless climb and outside of major markets, the price growth potential in the next 5 years is highest. Some cities are hurting so invest carefully. Take a look at the best cities to invest in real estate and share your stories of which cities we should know about.

Here’s 7 Reasons Why People Are Still Eager to Buy Real Estate:

1.) home prices are appreciating

2.) millennials need a home to raise their families

3.) rents are high giving property owners excellent ROI on rental properties

4.) flips of older properties continue to create amazing returns

5.) real property is less risky (unless you get over leveraged)

6.) the economy is steady or improving (although Trump’s letting his enemies cause too much friction)

7.) foreigners including Canadians are eager to own US property

Latest real estate market reports:

There are more renters now than in the last 30 years.

US homes are at their highest value ever

Foreign buyers buying record number of properties

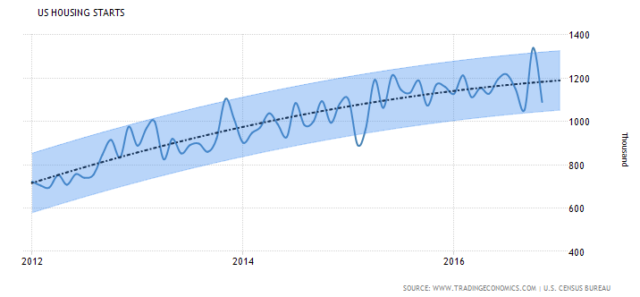

Housing starts more than expected but not enough to fill demand

Here’s a short list of positive factors that will affect the US Housing Market 2017 and beyond:

1.) moderately rising mortgage rates

2.) low risk of a housing crash for most cities

3.) millennials buyers coming into the main home buying years

4.) a trend to government deregulation

5.) labor shortages pushing up costs of production and incomes

6.) the economy will keep going – longest positive business cycle in history

The biggest factor even for 2017 is Donald Trump. The repatriation of business, investment and jobs back to the US may come with a big price — a high dollar and strong inflation. That will drive home prices higher, and renters will be desperate to start building financial equity and own a home in 2017 and 2018.

Expert Predictions – US Housing

1. Expert Prediction from Eric Fox, vice president of statistical and economic modeling (VeroForecast) — The top forecast markets shows price appreciation in the 10% to 11% range. The top forecast market is Seattle, Washington at 11.2%, followed by Portland, Oregon at 11.1% and Denver, Colorado at 9.9%.

These economies have robust economies, growing populations and no more than two month’s supply of homes. In fact, the forecast of the Boston market increase sharply to 7.4% is due to reductions in inventory and unemployment. On the other hand, the worst performing market is Kington, New York with 2.5% depreciation, followed by Ocean City, New Jersey at -2.1%, Kingsport, Tennessee at -1.9% and Atlantic City, New Jersey and San Angelo, Texas tied at -1.4%. — BusinessWire

2. Pantheon Macro Chief Economist Ian Shepherdson explains that “Homebuilders behavior likely is a continuing echo of their experience during the crash. No one wants to be caught with excess inventory during a sudden downshift in demand. In this cycle, the pursuit of market share and volumes is less important than profitability and balance sheet resilience.” — Marketwatch.

Housing Construction Starts Will Slowly Rise

It’s predicted that new home construction won’t keep up with demand, however it is recovering and we’ll see more renters becoming homeowners over the next decade.