加州新屋開工數據

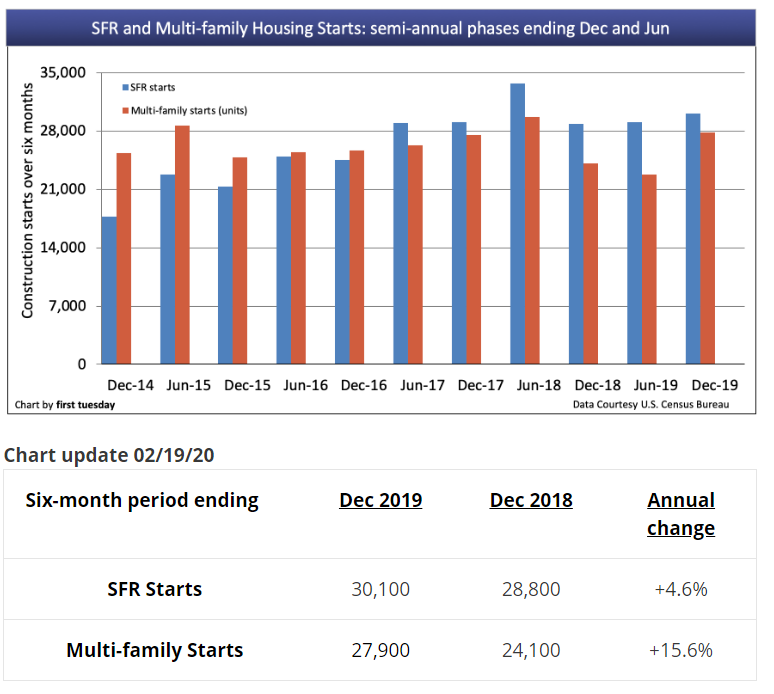

Single family residential (SFR) starts were 5% above one year earlier in the six-month phase ending December 2019. Multi-family construction starts were up 16% from a year earlier.

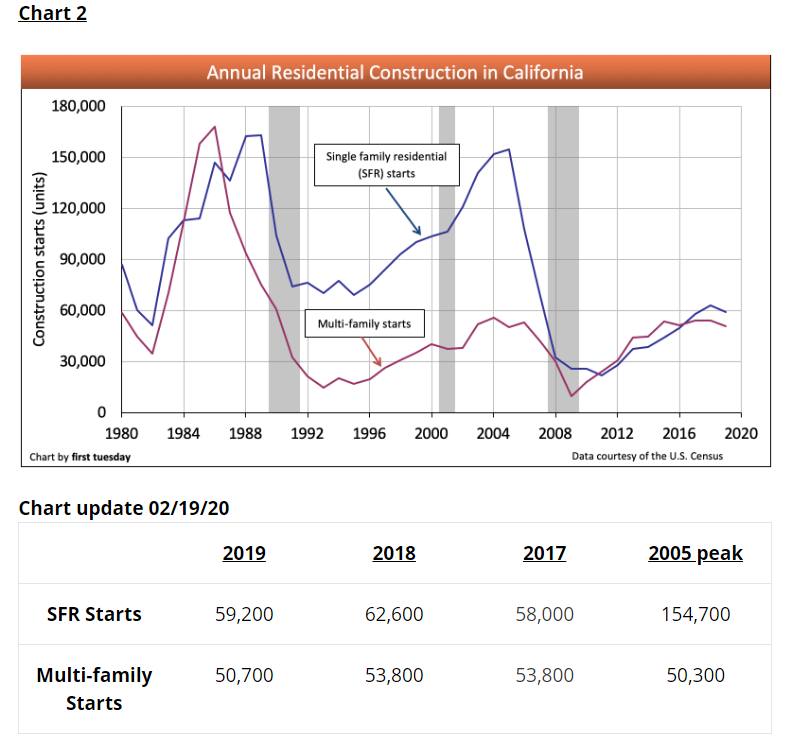

However, multi-family construction experienced a 6% decrease in 2019 from the prior year. Demand for multi-family rentals has generally been higher during this residential construction recovery compared to new SFRs. However, buyer-occupant demand for SFRs is gradually increasing as jobs are recovered.

SFR construction starts also saw annual totals lower than the previous year, turning in a 5% decrease from 2018. SFR construction is expected to continue to slow in 2020, the result of 2018’s rising mortgage rates and 2019’s slowing sales volume and home prices. Further, compared to the 150,000 SFR starts achieved in 2005 at the height of the boom, even 2018’s positive performance – resulting in 62,600 SFR starts – is a fraction of what is needed to meet demand.

Like SFR construction, multi-family starts amount to just a small amount of what is needed to keep up with rising demand from California’s growing population. State-initiated legislative efforts to add to the low- and mid-tier housing stock have focused on encouraging more multi-family construction. Therefore, the slowing in multi-family construction will not be as steep as that experienced for SFR starts, even as home sales slow across California.

Updated February 19, 2020. Original copy posted November 2012.

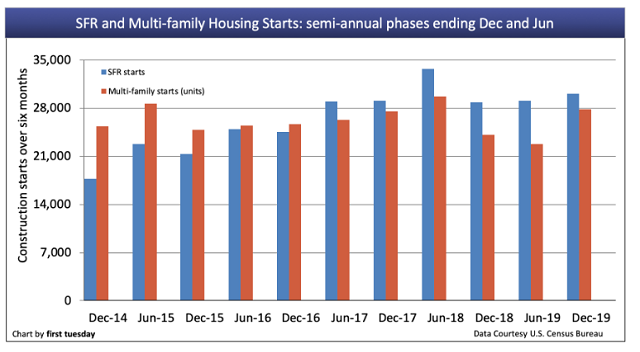

Chart 1

This chart illustrates the number of California residential construction starts during semi-annual phases ending in December and June.

*Forecasts are made by first tuesday and are based on current new home sale trends, actual construction starts and current government policies.

Detached single family residential construction trends in California:

- 30,100 SFR starts took place in the six-month period ending December 2019. This is 1,300 more starts than occurred during the same period one year earlier.

- 59,200 SFR starts took place in 2019. This is down 5%, or 3,400 starts, from 2018.

- For perspective, this cycle’s peak year in SFR starts was 2005 with 155,000 starts. The lowest year was 2009 with 25,000 starts.

- Final reports issued for new subdivisions by the California Bureau of Real Estate (CalBRE) have remained constant for several years, roughly level during the past 12 months.