How Treasury Notes Affect Mortgage Rates

(Why Now Is the Best Time to Get a Mortgage)

BY KIMBERLY AMADEO

Updated February 10, 2020

Fixed mortgage rates are hovering near historic lows as investors flee to the safety of government securities.1 These rates follow the yields on U.S. Treasury notes. The coronavirus pandemic sent yields on the 10-year Treasury note to an all-time low of 0.54% on March 9, 2020.2

What’s more, the Federal Reserve lowered the target for the fed funds rate to virtually zero on March 15, 2020. That lowered rates on adjustable-rate mortgages that follow the Fed’s benchmark rate.

Key Takeaways

- Treasury bonds are one of the world’s safest investments.

- As with any bonds, when Treasury prices go up, there is a corresponding drop in yields.

- Fixed mortgage rates follow Treasury yields.

- The best time to get a fixed-rate home loan is when Treasury yields are low.

How Mortgage Rates Follow Treasury Yields

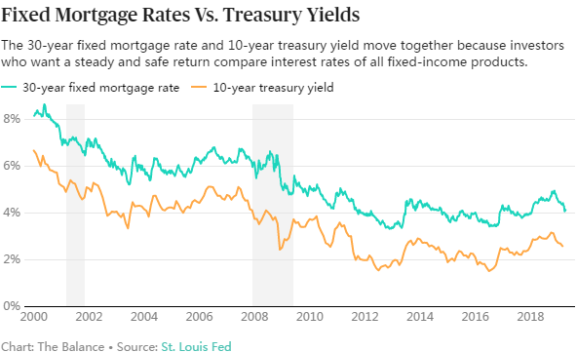

U.S. Treasury bills, bonds, and notes are a bellwether for fixed mortgage rates, as shown by the chart below.

So how exactly do Treasury yields affect interest rates? Investors who want a steady and safe return compare the interest rates of all fixed-income products. They compare yields on short-term Treasurys to certificates of deposit and money market funds. They compare yields on long-term Treasurys to mortgage-backed securities and corporate bonds. All bond yields are affected by Treasury yields because they compete for the same type of investor.

IMPORTANT: Treasury notes are safer than any other bond because the U.S. government guarantees them.

CDs and money market funds are slightly riskier for investors since they aren’t guaranteed. To compensate for the higher risk, they offer a slightly higher interest rate. But they are still safer than any non-government bond because they are short-term.

Mortgages, in turn, offer a higher return for more risk. Investors purchase securities backed by the value of the home loans—so-called mortgage-backed securities. When Treasury yields rise, investors in mortgage-backed securities demand higher rates. They want compensation for the greater risk.

Those who want even higher returns purchase corporate bonds. Rating agencies like Standard and Poor’s grade companies and their bonds on the level of risk. These bond prices affect mortgage rates because bonds and mortgages compete for the same low-risk investors who want a fixed return.

Fed Funds Rate and Adjustable-Rate Mortgages

Treasury yields only affect fixed-rate mortgages. The 10-year note affects 15-year and 30-year conventional loans.

For adjustable-rate mortgages (ARMs), it’s the fed funds rate that has the most impact. The fed funds rate is the rate banks charge each other for overnight loans needed to maintain their reserve requirement. It influences both LIBOR and the prime rate, two benchmarks used in pricing adjustable-rate loans. The Fed has lowered the target for the fed funds rate to a range of 0%-0.25% just two times in history, once amid the 2008 financial crisis and once in March 2020.

How Treasury Notes Work

The U.S. Treasury Department sells bills, notes, and bonds to pay for the U.S. debt. It issues notes in terms of two, three, five, and 10 years. Bonds are issued in terms of 30 years. Bills are issued in terms of one year or less. People also refer to any Treasury security as a bond, Treasury product, or Treasury. The 10-year note is the most popular product.

The Treasury sells bonds at auction. It sets a fixed face value and interest rate for each bond. If there is a lot of demand for Treasurys, they will go to the highest bidder at a price above the face value. That decreases the yield or the total return on investment. That’s because the bidder has to pay more to receive the stated interest rates. If there is not a lot of demand, the bidders will pay less than the face value. That increases the yield. The bidder pays less to receive the stated interest rate. That is why yields always move in the opposite direction of Treasury prices; to keep up with current interest rates, the prices and yields on bonds that trade in the open market are continually readjusting.

NOTE: Treasury note yields change every day. That’s because investors resell them on the secondary market.

When there’s not much demand, bond prices drop and yields increase to compensate. That makes it more expensive to buy a home. And when buyers have to pay more for their mortgage, they are forced to buy less expensive homes. That encourages builders to lower home prices.

Low yields on Treasurys mean lower rates on mortgages. Homebuyers can afford a larger home. The increased demand stimulates the real estate market. That boosts the economy. Lower rates also allow homeowners to afford a second mortgage. They’ll use that money for home improvements or for purchasing more consumer products. Both stimulate the economy.