Jamestown to Buy 116 New Montgomery in San Francisco for $110MM

Jamestown to Buy 116 New Montgomery in San Francisco for $110MM

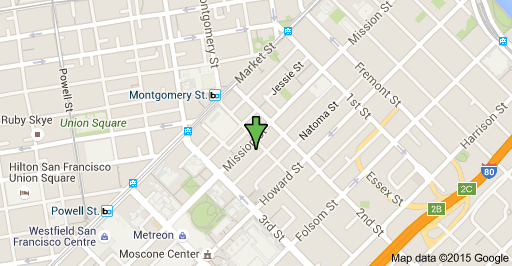

Jamestown will be buying the 137,000 square foot 116 New Montgomery office building in San Francisco for just over $110 million or around $810 per square foot, according to several sources that track the sales of major office building in the city. The transaction is under contract and the transaction is projected to close before the end of the year.

The sellers of the property were the San Francisco office of Hines and Atlanta-based Invesco Real Estate. Hines declined to comment when contacted for this story.

The asset is also known as the Rialto Building. Hines and Invesco had purchased the property for $57 million or $434 per square foot in March of 2013, which The Registry first reported. The cap rate on this transaction was in the five percent range. At that time the property was 85 percent occupied. The owners had planned an $11 million renovation to the office part of the property. The idea was to conduct improvements to the interior and exterior for both tenant space and common areas.

In September of this year the two owners put the property up for sale, which was done through the San Francisco office of Eastdil Secured as the listing agent. When this happened the property was a fully occupied asset. The tenants in the office space of the property included EnerNOC, Nelson/Nygaard, Nordash and SocialCode.

The Rialto Building does have a significant amount of retail, as well. The 21,000 square foot retail space on the ground floor is leased to Walgreens and Chipotle Mexican Grill, among others.

Jamestown has a regional office in San Francisco located at 1700 Montgomery Street. The real estate investment firm is a major owner of real estate assets in the San Francisco Bay Area. According to its Web site, these assets include 799 Market and Ghiradelli Square in San Francisco, Alameda South Shore Center in Alameda and Fourth Street in Berkeley.

The real estate manager’s main investment entity is the Jamestown Premiere Property Fund. This is a core/core plus open-ended commingled fund that buys properties nationally. It is active in a variety of markets around the country including San Francisco, Los Angeles, New York City, Boston and Washington, D.C. Most of its investments for the commingled fund are office, retail and mixed-use properties.