FORTUNE 500 PART 2: HERE ARE THE BOTTOM 13 INDUSTRY ENTRANTS

FORTUNE 500 PART 2: HERE ARE THE BOTTOM 13 INDUSTRY ENTRANTS

Jun 09, 2016

Fortune just put out this year’s Fortune 500 list of top companies—Bisnow sifted through the names to find how real estate firms stacked up. Here’s Part 2 of our breakdown, with firms in the bottom half of the list. (Check out Part 1 here.)

Simon Property Group

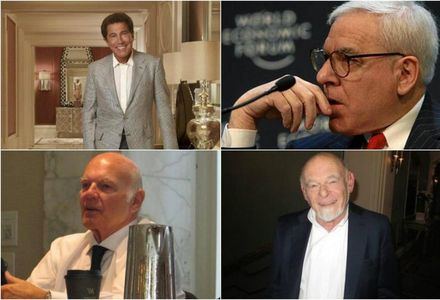

CEO: David Simon (pictured)

HQ: Indianapolis

Spot On The List: 488

Employees: 4,075

The country’s largest real estate investment trust moved up from 529 in the rankings last year, as it saw profits rise by nearly 30% over the same time. The US’s largest shopping mall owner seems to have recovered from its failed $16.8B bid for Macerich last year.

Blackstone Group

CEO: Stephen A. Schwarzman (pictured)

HQ: New York

Spot On The List: 536

Employees: 2,060

The world’s largest alternative asset manager had a rough year, with its profits cut in half, by Fortune’s reckoning. Still, the PERE giant has come a long way since its founding in 1985.

Hyatt Hotels

CEO: Mark S. Hoplamazian

HQ: Chicago

Spot On The List: 562

Employees: 45,000

Hyatt bumped up 21 spots from last year, although it has yet to break into the top 500. Despite that rise in Fortune ranking, the firm saw a 64% decrease in profits over the past year.

Toll Brothers

CEO: Douglas C. Yearley Jr.

HQ: Horsham, PA

Spot On The List: 576

Employees: 39,000

Toll Brothers saw a much larger jump in rankings than Hyatt, up from 628 last year. The luxury homebuilder also made Fortune’s list of fastest-growing companies, at No. 53.

Wynn Resorts

CEO: Stephen A. Wynn (pictured)

HQ: Las Vegas

Spot On The List: 585

Employees: 20,800

Wynn saw a big drop in rankings on the year, falling from 477 as its profits took a 73.3% dive. The company has been expanding its holdings in Macau, despite a slowdown in the Chinese city.

Ventas

CEO: Debra A. Cafaro (pictured)

HQ: Chicago

Spot On The List: 651

Employees: 466

Ventas also saw a drop in profits on the year, although not quite as much as Wynn, at just 12.2%. It has been just over a year since the Chicago-based company bought and spun off nursing and rehab properties from Ardent Medical Services.

Carlyle Group

CEO: David Rubenstein (pictured), William E. Conway Jr.

HQ: Washington, DC

Spot On The List: 730

Employees: 1,700

This PERE giant dropped 101 spots from its place on the list last year. Carlyle and its peers had a particularly difficult Q1 amid market turmoil and rock-bottom oil prices.

Equity Residential

CEO: David J. Neithercut

HQ: Chicago

Spot On The List: 781

Employees: 3,500

Sam Zell’s (pictured) Equity Residential just revealed that a slowdown in gateway cities has it struggling. The Grave Dancer himself has predicted a recession in the coming months—although he hasn’t broken out his classic pre-recession poetry yet (that we know of).

Vornado

CEO: Steven Roth (pictured)

HQ: New York

Spot On The List: 833

Employees: 4,089

Vornado has dropped 19 spots on the list after a 12.1% drop in profits on the year. The company has just moved into co-working and co-living, opening a WeWork and WeLive in Crystal City, DC.

Boston Properties

CEO: Owen D. Thomas (pictured)

HQ: Boston

Spot On The List: 846

Employees: 765

Boston Properties has seen a nice 50-spot bump on the list since last year, and a profit increase of over 30%. The East Coast company just made its first foray into SoCal, buying a $500M office complex from Blackstone.

General Growth Properties

CEO: Sandeep Mathrani (pictured)

HQ: Chicago

Spot On The List: 861

Employees: 1,700

GGP, one of the country’s largest mall operators, has seen a 104% increase in profits over the past year, up to $1.3B. The retail REIT is investing in high-tech maps and other amenities to bring shoppers to its malls.

Public Storage

CEO: Ronald L. Havner Jr. (pictured)

HQ: Glendale, CA

Spot On The List: 870

Employees: 5,300

Public Storage is an oddball on this list, as the only self-storage REIT. Yet it has been a cash cow on Wall Street, with shares up 17% annually over the past 20 years—more than doubling the S&P 500 average.

Hospitality Properties Trust

CEO: John G. Murray

HQ: Newton, MA

Spot On The List: 988

Employees: 400

This real estate firm just barely squeezed onto Fortune’s top 1000 list, and if its falling profits continue (down 15% for the year) it could be on its way out. Still, over the last month the lodging REIT’s shares have trended upward.