San Francisco Commercial Real Estate

San Francisco Commercial Real Estate

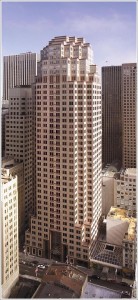

Mass PRIM Buys Into Purchase of 333 Bush Street

Boston-based Massachusetts Pension Reserves Investment Management Board (Mass PRIM) has made a $90 million investment into the acquisition of the 543,000 square foot 333 Bush Street in San Francisco. According to sources familiar with the deal, the total purchase price was in the range of $507 per square foot or $275 million.

“Our view of the San Francisco office market is that it has been performing at a high level for some time. We think that the market will continue to have steady growth going forward and that this investment will be a good one for us,” says Tim Schlitzer, senior investment officer for real estate and timber for Mass PRIM.

The pension fund stated in a board meeting document that the investment is considered to be a non-core one. The transaction was completed for Mass PRIM through its real estate separate account manager, Boston-based AEW Capital Management. AEW declined to comment when contacted for this story.

The seller of the property was Toronto-based Brookfield Asset Management. It had hired Eastdil Secured, in its San Francisco office, as the listing agent. Both of these firms chose not to comment through e-mails and phone calls.

AEW acquired the property in a joint venture with DivCore, an entity formed by San Francisco-based DivcoWest Properties and Greenwich, Conn.-based LoanCore Capital. DivcoWest declined to comment.

333 Bush was developed in 1986, and the current occupancy is 88 percent. According to a document from Cassidy Turley BT Commercial, the 43-story property is considered to be a Class A asset.

The property is located in the North Financial sub-market of San Francisco. According to Colliers International’s third quarter 2013 research & forecast report for office buildings in San Francisco, this region has 116 office buildings totaling 28.4 million square feet. There was a slight improvement in vacancy from the second to third quarter in this region. It went from 9.1 percent to 8.7 percent.