The Unicorn; Kabbage; 独角兽企业; 146/174

Company Information |

|

|---|---|

| Valuation | $1 billion |

| Sector | Financial services |

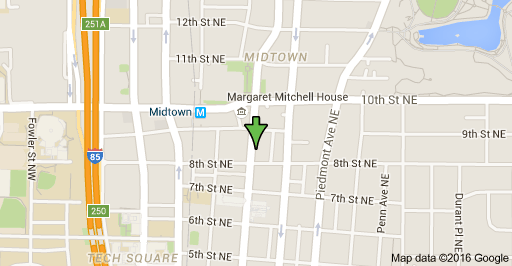

| Headquarters | Atlanta, Ga. |

| Founded | 2009 |

| CEO | Rob Frohwein |

Kabbage

Kabbage, Inc. is an online FinTech company based in Atlanta, Georgia.[1] The company provides funding directly to small businesses and consumers through an automated lending platform.

History

Kabbage, Inc. was established in 2009 by Rob Frohwein, Marc Gorlin, and Kathryn Petralia.[1] The financial services data and technology platform based out of Atlanta, Georgia, publicly launched and began making its first loans in May 2011.[3] Kabbage is venture funded and backed by Reverence Capital Partners,[4] SoftBank Capital,[5] Thomvest Ventures, Mohr Davidow Ventures, and BlueRun Ventures[6] and is debt funded by Victory Park Capital.[1] Additional investors include: ING, Santander InnoVentures, Scotiabank,[4] TCW/Craton David Bonderman, Warren Stephens,[7] the UPS Strategic Enterprise Fund, TriplePoint Ventures,and Jim McKelvey.

In 2012, Kabbage opened its San Francisco office and appointed Victoria Treyger as Chief Marketing Officer.[14][15] That same year, Kabbage raised $30 million in Series C financing, led by Thomvest Ventures, and was named one of Red Herring’s Top 100 North American private companies.

In February 2013, the company expanded internationally, entering the United Kingdom,[17] and was named one of the Top 10 Most Innovative Companies in Finance by Fast Company.[18] Also in 2013, Kabbage raised $75 million in debt financing, led by Victory Park Capital and existing investor Thomvest Ventures.

In 2014, Kabbage raised an additional $106 million in funding from SoftBank Capital, TCW/Craton, Lumia Capital, the UPS Strategic Enterprise Fund, Thomvest Ventures, BlueRun Ventures and Mohr Davidow Ventures.[5] In April 2014, Kabbage closed a $270 million credit facility from Guggenheim Securities, the investment banking and capital markets division of Guggenheim Partners.[19] A BBB debt rating was obtained by Kabbage on $136 million of Class A notes that were part of the $270 million facility obtained from Guggenheim Securities.

Kabbage extends $1 billion each year in working capital funded to small businesses.[21] In 2015, the company was named to Forbes Magazine’s Top 100 Most Promising Companies for the second year in a row.

In October 2015, Kabbage completed a Series E funding round of $135 million led by Reverence Capital Partners. Holland’s ING, Spain’s Santander (via InnoVentures, Santander’s venture capital arm); and Canada’s Scotiabank also participated in the round.[24] This latest funding values the company at over $1 billion.[4] Kabbage also announced a strategic partnership with ING to deliver instant capital to small businesses throughout Spain.

Rob founded Kabbage to get small businesses capital quickly, an area in which banks have long struggled.

He believes deeply that small businesses are at the core of economic development around the world. Rob’s also a 3-time author, former co-host of a radio show, inventor with more than 30 patents and applications — and the owner of a lifetime pass to the Baseball Hall of Fame.

Favorite small business: Bull’s BBQ at Citizen’s Bank Park, owned by former Philadelphia Phillie Greg Luzinski.