Real Estate Outlook 2/3

Mortgages

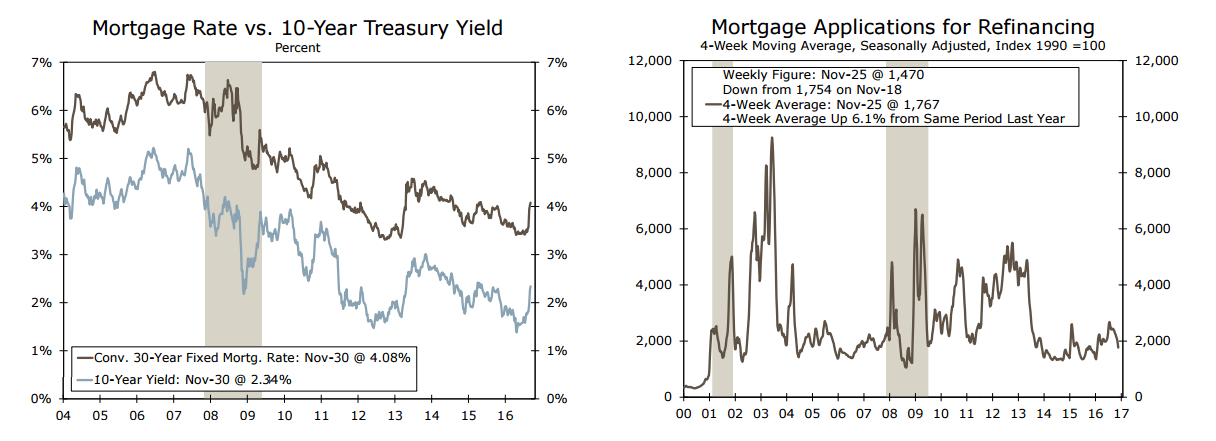

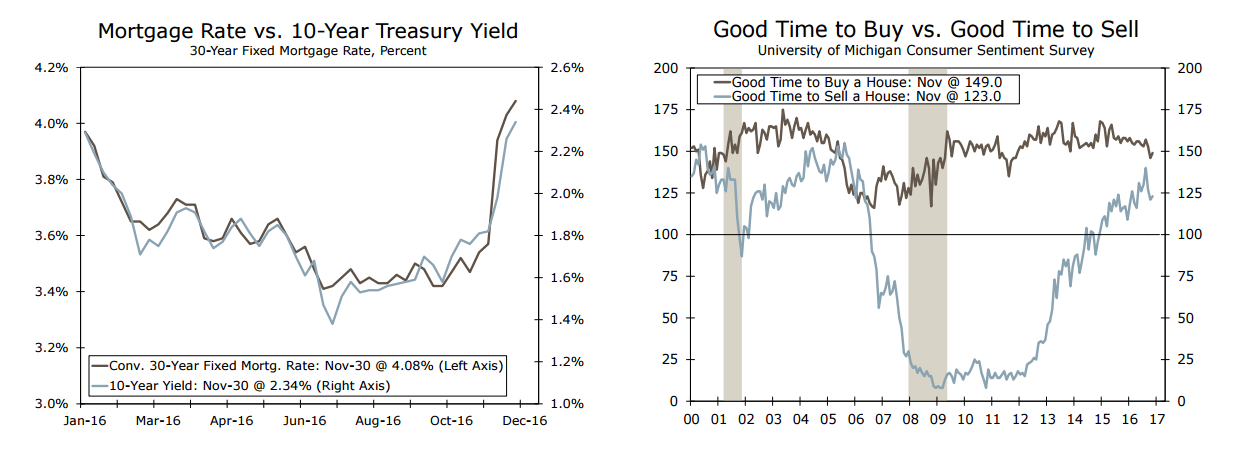

Long-term mortgage rates have continued to march higher in the aftermath the U.S. election. According to Freddie Mac, the average 30-year fixed mortgage rate has risen roughly half a percentage point since the election to 4.08 percent during the week ended Nov. 30, marking the highest rate since July 2015.

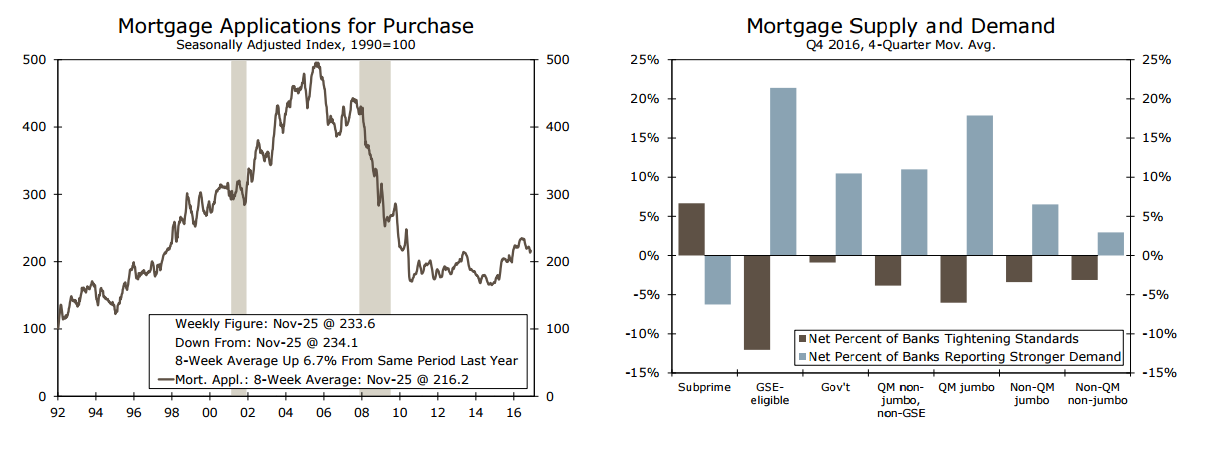

Mortgage purchase applications also spiked during the week following the election, rising 18.8 percent as the threat of even higher rates likely encouraged some potential homebuyers to lock in a mortgage. However, mortgage applications for refinancing, which are more highly sensitive to interest rates, continued to falter, reporting an eighth consecutive decline for the week ended Nov. 25.

Single-Family Construction

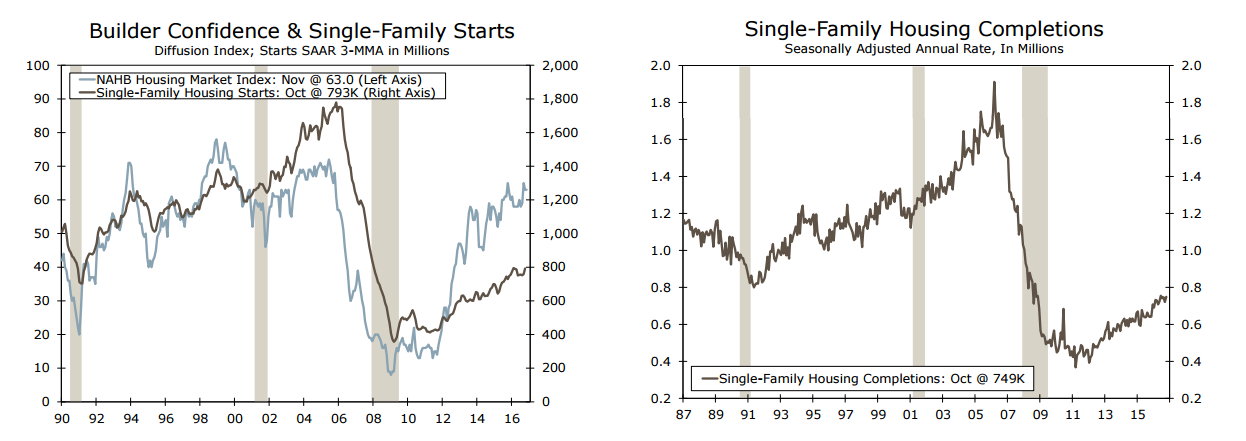

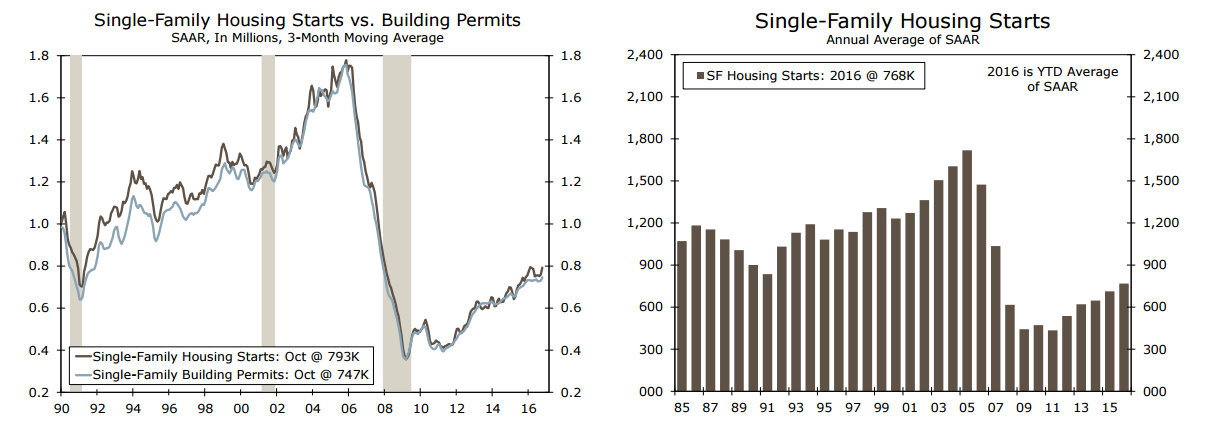

Single-family housing starts started off the fourth quarter on a solid footing, rising 10.7 percent in October. The reported strength in single-family construction coincides with generally positive home builder sentiment. The NAHB/Wells Fargo Housing Market Index has averaged more than 60 over the past six months and builders report strong demand across much of the country.

While stronger housing starts are encouraging, starts are now running well ahead of permits. Milder weather may have boosted starts in recent months. On a three-month moving average basis, single-family housing permits are roughly 6 percent below starts, suggesting some payback in starts in the coming months.

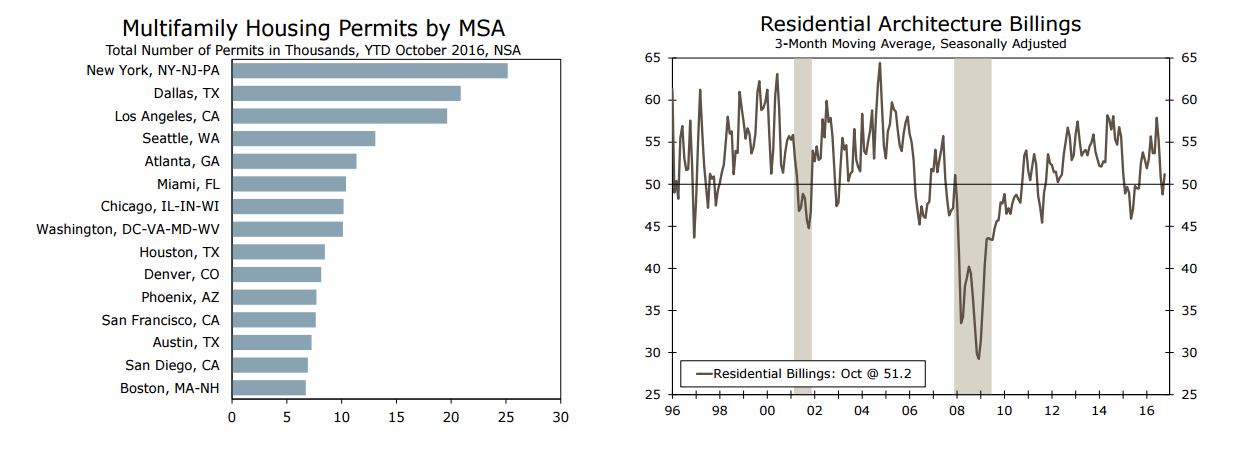

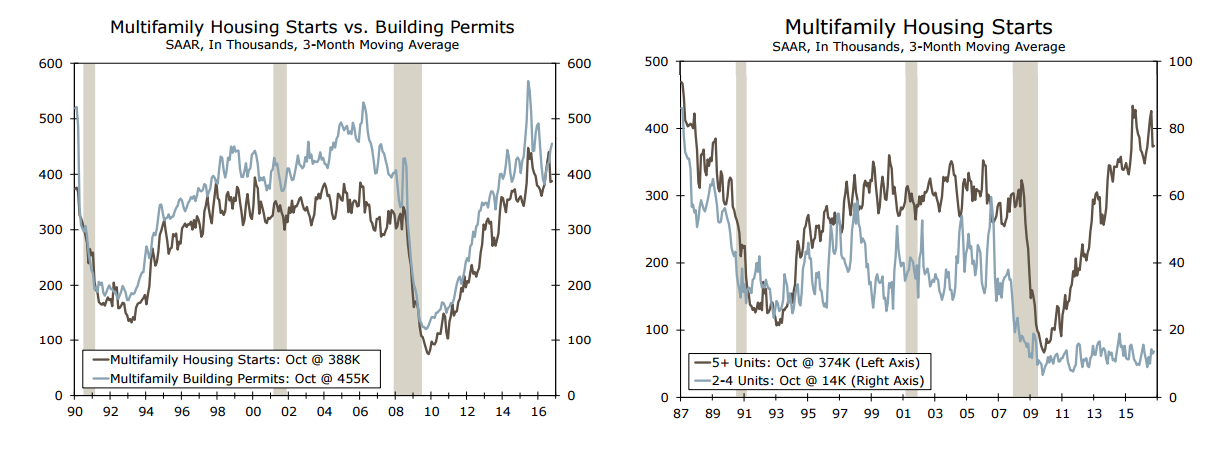

Multifamily Construction

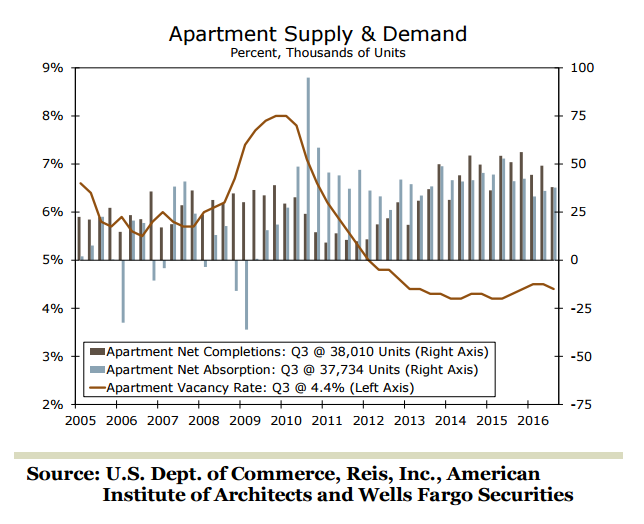

Multifamily construction activity picked back up in October, following a sizable decline in September. Apartment completions have exceeded demand for the past six quarters, but the margin has narrowed. Rent increases have also eased somewhat.

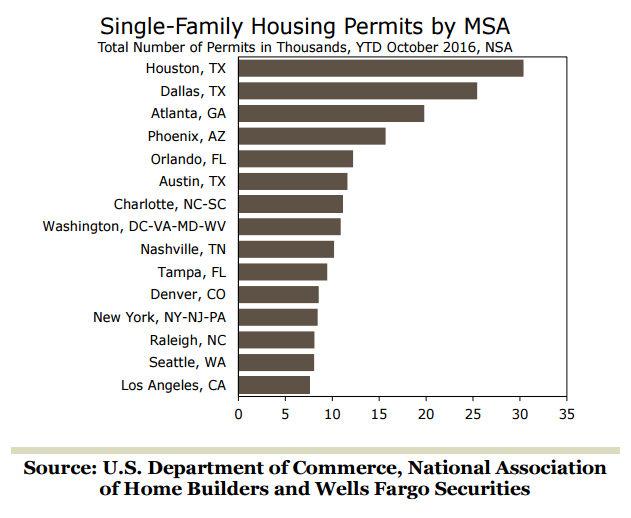

The bulk of multifamily building is in the South, which has accounted for more than 40 percent of the nation’s multifamily starts over the past 10 months. Apartment construction has been particularly strong in the Dallas, Atlanta and Miami metropolitan areas.

While multifamily starts appear to have topped out, construction will likely remain solid as permits are running a good bit ahead of starts.

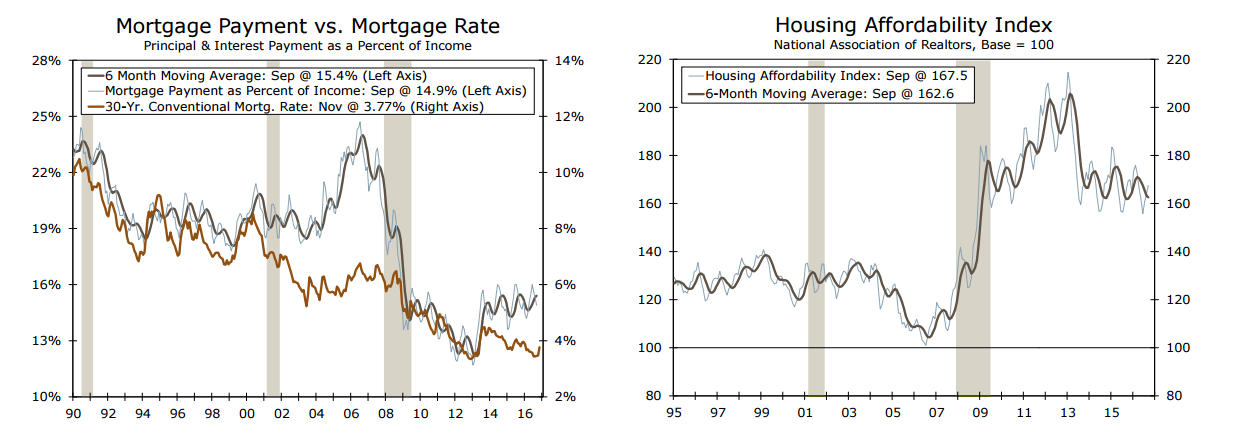

Buying Conditions

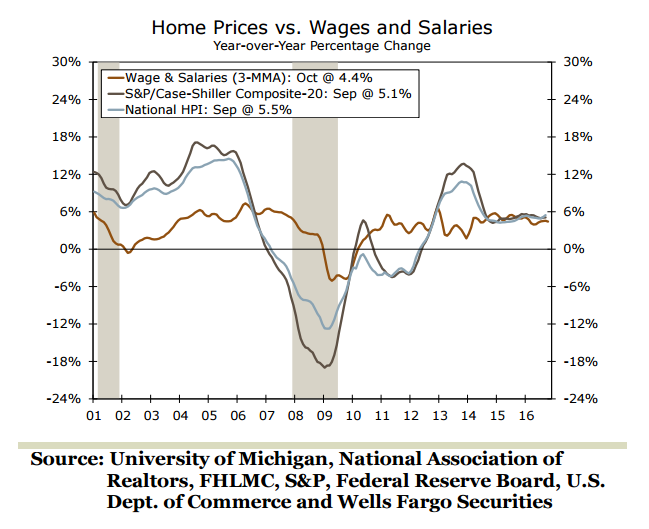

Various measures of buying plans suggest that home sales may run into a soft patch. While the proportion of consumers in the University of Michigan’s Consumer Sentiment Survey stating that now is a good time to buy a home inched up in November, it remains well below the highs hit earlier this year. Most of the drop has been due to higher home prices, which have reduced affordability. Now that mortgage rates have risen, we expect the proportion of consumers that believe now is a good time to buy a home to fall a bit further.

Home price appreciation has moderated and starts of more modestly priced new homes have risen in recent months, which should offset some of the drag from rising mortgage rates.

20161205